Do you assign a cons code or attribute to donors giving via DAF, IRA, etc?

We are being asked to assign some type of code to donors who contribute via a Donor Advised Fund, Retirement Distribution, IRA/QCD. Would you please share if/how you track this? The colleague requesting the information hasn't decided what they will do with the information, so I am not sure if a constituent code or attribute will be best - if they're wanting to group donors - or if a gift attribute is best - if they want to identify the gifts.

Thanks in advance for your help!

Comments

-

@Cathy Spencer That's a complicated question until it's known what the why is behind it. I think it will depend on how you enter those gifts (soft credits & hard credits) but at first blush, I'd use a gift attribute to identify the gifts that qualify. Then the donors could be pulled with a specific date range, or all donors that qualify ever, or whatever. Plus, donors who give through DAFs don't do that 100% in my experience. This would make me use something other than a constituent code. If not a gift attribute/custom field, then a constituent attribute/custom field. Also, I think you should ask if dates are needed with this data.

6 -

@Heather MacKenzie

Thank you for your suggestions, Heather. It's always good to hear from you!?2 -

@Cathy Spencer I would go with Heather's advice, gift attribute, since like she said donors do not always give thru a DAVF. But definitely do not use a constituent codes. Too many ORGS tend to make such a wreak of something that should be simple and general.

4 -

Thanks @Joe Moretti - I agree about not making things a muddle - keeping it simple and clean. I appreciate your help.

2 -

@Cathy Spencer

Hi Cathy,We use a combination of con codes and gift reference (comment) lines for max. flexibility in queries. Gift reference(comment lines) are also more readily visible to other users and to our finance department for monthly reconciliation as the DAFs are soft credited. We are looking to engage IRA or DAF donors to a greater degree and they often give using these vehicles across funds and yes, inconsistently. But of course, what works best for us might not for your purposes. Happy to discuss in detail. Just contact me directly.

Susan Raymer, DBA, Lighthouse MI

1 -

@Cathy Spencer I'm right in there with @Heather MacKenzie and @Joe Moretti with the response and also in enjoying the community members involved in this thread! So sad to not be going to bbcon in person this year.

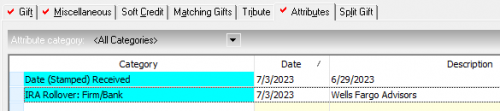

I created a gift attribute of IRA Rollover: Firm/Bank and we have a table with the common sources that the gift entry person can add to. It is one of the few tables that I haven't completely locked down. This helps as we so often get checks with no identification of which donor to attribute it to. This way we can narrow down some calling to known IRA donors first.

At our org our policy is to consider our gift date to be the postmark date or the check date whichever is later. For IRA rollovers we want to capture the date it was actually received and we include that in our acknowledgements.

We are still entering most gives through the DBV and have a separate batch template for IRA rollover entries so we can capture all the things we need to without having to think too much about it since we might get 20 to 30 a year.

In the reference field, I have a prompt: “IRA Rollover; Copies of checks made”

This helps to remember that we share a copy of the check with the acknowledgementWe set the receipt amount to $0 as they have already received their tax benefit and our letter is truly a thank you.

We insert the Firm/Bank into that letter as well.

Right now we have a gift subtype of IRA Rollover. I'm cogitating if I want to keep this or not. Part of a bigger redesign to accommodate how to use the web view with its limited fields.

It is our regular acknowledgement letter and the formulas change the letter for IRA Rollovers.

Here are some visuals

2

2 -

@Elizabeth Johnson - thank you so much for your response. I like the idea of a separate batch template for these gifts. We don't get too many of them a year either - and this would help my thought process. I appreciate the visuals and explanation.

I am also sad not to be going to bbcon - I always enjoy them. Maybe next time!

Thanks again for your insight!

1 -

@Susan Raymer - thank you for your response. I believe our team is wanting to engage these donors more as well. I appreciate your feedback on how you approach this.

0 -

@Cathy Spencer Yes fingers crossed for next year - can't wait to hear where it will be and maybe the community @Crystal Bruce ? will have more competitions to cover fees and I'll get to hear your singing!

0 -

@Cathy Spencer

I've set it up as a Gift Attribute. Easy enough to pull from there.1 -

I found this discussion very interesting - even bookmarked it for reference on how others are tracking.

We receive several of these gifts each week. Our process is essentially no different than for any other type of gift. Our thank you letters verbiage covers both qualifying and non-qualifying contributions.As to encouraging these types of gifts, our focus is on all donors age 70.5 encouraging them to use this vehicle, not just those currently do use it. Yes, it does require having DOB which fortunately as a university we have for most of our alumni (missing a couple years when data wasn't uploaded ?).

4 -

@Christine Cooke bCREPro - thank you!

0 -

@Elizabeth Johnson - ha! You remember that! ?

1 -

We add an organization relationship to the DAF holder for every donor who gives through DAFs, with the name of their fund in that relationship record (as their position or in the notes if the donor is an organization). We also have a constituent code. We add a standard “DAF no tax receipt” in the reference of the gifts.

Thus far, I've only needed to pull DAF donors together in a list for staff at my organization, but we have the capability to pull lists of who gives through which financial institution and the gifts if needed.

2 -

@Sunshine Reinken Watson - thanks for this response. You all have great ideas. ?

2 -

I'm not a big fan of creating codes or attributes without a use case. As @Heather MacKenzie pointed out, donors usually have multiple methods of making their gifts, and may not use a DAF or IRA QCD for all of their donations.

My org uses gift attributes to note things like this, and as they are tied to the gift and not the donor record itself, it makes more sense. @Christine Cooke bCREPro mentioned something like this as well. It's very easy to run a gift query for these items and output the constituent information. But I would not put that information on the constituent record.

4

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 124 Ninja Secret Society

- 32 Blackbaud Raiser's Edge NXT® Receipting EAP

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board