EOY Tax Letters - Do you send them?

Inspired by @F Shane Johnson earlier query, I wanted to throw out a question to all. Do you send end of year tax letters and why? It's a bit of a loaded question, but I'm curious as to how many organizations send tax letters to all of their donors who contributed over the tax year, or if the letters are only sent to recurring donors or those who gave over $250. And more importantly, why does your organization do it that way?

Granted, there is no wrong answers here…unless you don't know why it's done that way or, “that's the way we've always done it.” I think this whole concept needs a rethink. We know these summary tax letters are not completely necessary if the donor was receipted at the time of the gift. However, organizational culture, constituent population and demographics play an important role to these decisions. Does the number of letters play a part in these decisions? It's a big difference between sending 1000 letters versus 500 or 5000.

I've seen it done a variety of ways, and I've done it a variety of ways. I'm just curious as to what other folks do? When you respond, I'd be curious as to how many donors your organization would be sending them to. I'd imagine I'd get a different response in the Blackbaud CRM pages, where those organizations are much larger.

Comments

-

@Dariel Dixon At both orgs I have been at procedure has been to send EOY ‘tax’ letters to monthly donors and staff with payroll deductions, regardless of gift amount. These constituents have not received other receipt documents.

We do a consolidated receipt. Here, we have a few with monthly amounts $250 or greater so will enclose a list of gifts/dates with those letters only.

Quantity - around 150 letters.

5 -

@Dariel Dixon

We started out only sending to donors who specifically requested one, because as you said, their tax language is included on their initial receipt. When I started, we sent maybe 30 a year.When we launched our monthly donor program, we added those donors in as well. The reason is because part of our program is not to send monthly thank-you letters. The donors usually like the idea of saving us postage, and not all have email addresses for digital receipts.

Then last year, we began adding in mid/major donors above $1,000. We had never sent out annual reports, and we realized we were missing an opportunity to slip in an end-of-year impact statement. So this year, we are sending tax receipts along with a hand-signed letter and a 2-sided impact statement. Total quantity is about 6-700.

We really did think about sending to all donors, but the cost and mechanics were just too prohibitive. We always send tax summaries in mid-January, but you can't merge and print them until all posted mail from Dec 31st has trickled in …. which usually takes about 7 days if you watch the postmarks. So, with only one week to pull, merge, edit, print, and stuff, we just didn't want to kill ourselves doing 5,000 donors in one week. And it's too fast a turnaround time for a mail house.

6 -

@Faith Murray:

Then last year, we began adding in mid/major donors above $1,000. We had never sent out annual reports, and we realized we were missing an opportunity to slip in an end-of-year impact statement. So this year, we are sending tax receipts along with a hand-signed letter and a 2-sided impact statement. Total quantity is about 6-700.We really did think about sending to all donors, but the cost and mechanics were just too prohibitive. We always send tax summaries in mid-January, but you can't merge and print them until all posted mail from Dec 31st has trickled in …. which usually takes about 7 days if you watch the postmarks. So, with only one week to pull, merge, edit, print, and stuff, we just didn't want to kill ourselves doing 5,000 donors in one week. And it's too fast a turnaround time for a mail house.

@Faith Murray I like this way of thinking. It's being smart with your touches. It's just smart stewardship to turn a transactional mailing into something more meaningful, with little overhead and expense. I'm all about this.

I don't think these letters should be just transactional; they should serve a purpose, whether that be to inform, inspire, or show appreciation (preferably all three). I've been with organizations that have used these letters to create confidence. We had donors who started to question if their donations were being appropriated accurately, and we took time to create detailed documents showing their giving history over the year. Some organizations, like yours used it to show impact. Others have made it extremely transactional with all donors to try to get people in the habit of keeping track of their receipts when the gifts are initially made, in the case of people who make one-time donations.

Mailing to more than 1000 donors at once is an expense that needs to be planned for and budgeted. It's worth considering if there will be a tremendous savings impact if you don't mail to everyone and limited these letters to those with recurring donations, or didn't mail them at all and delivered them digitally only upon request (gasp).

4 -

@Dariel Dixon

We send out annual statements to donors who gave over $250. It usually involves 200-250 letters and we run them through our postage meter to get a cheaper rate. It is a pretty automated process but we do have a handful of long-time donors whose statements need to be tweaked a tad.Our Development Director likes sending these out as a touch point to begin the year.

3 -

@Dariel Dixon

I have the same experience as @JoAnn Strommen. We send tax letters/thank you letter to every donor at the time of their gift. We send annual tax statements to staff payroll donors (even though we are not required since it is on their W2) and any donor who requests them. We have very few emails, so it is snail mail for us. About 200 letters.3 -

@Dariel Dixon

We send them to our $250+ to cover our bases (even though they receive an acknowledgment at the time of the gift) and to monthly donors. It also serves as another “touch”. What I am having a difficult time determining is if we SHOULD or SHOULD NOT send these “tax summary” letters for gifts that were paid from a qualified charitable distribution, which is already noted in the initial acknowledgement letter. And if I SHOULD send them, are they also required to be sent out by the January 31 deadline? Does anyone have any information that clarifies the legalities of tax summaries for QCDs?1 -

@Lynne Stern From my understanding, QCDs get filed by the IRA custodian to the IRS and a 1099-R is sent with the date of distribution. The emphasis is there because the gift date for most organizations is the date the gift arrives. The date of distribution is the date the funds leave the donor's account, or in other words, when the check clears. Since that information is already sent by the custodian on the behalf of the donor, I don't know if a tax statement is necessary or if it is subject to the January 31 deadline. And with the rules for QCDs changing this year, I am still familiarizing myself with everything.

I would probably err on the side of caution and send them.

1 -

@Dariel Dixon We are a relatively small independent school. Everyone except employees doing payroll deductions or “requests no Ack letters on recurring” are the only folks that do not get a letter at time of gift.

But we send EOY tax statement to every one of our contributors with a cover that reviews accomplishments for the year. It's 200 and change statements.

2 -

This is eye opening…

I am shocked at the amount of letters being sent out. Just for comparison, most of the organizations I've worked with have sent letters to all donors. Even those that sent only to recurring or interval donors had at least 500 letters being sent out.

Last year, my organization wanted to try to quell any questions donors had about their giving. So instead of the usual summary, we decided to create a detailed list for every donor that gave in the reporting period. That way, the donor would see all the gifts and could contact us (read: me) with any questions or concerns. That list was in the thousands.

I was sitting here thinking that was about normal. Maybe it wasn't?

1 -

Allow me to up this post again. I'm curious to see any new responses, since it's about that time of year.

0 -

@Dariel Dixon Same as last post - only to the ‘unreceipted’

I have to wonder about need as well for giving summaries. Our end of year efforts are in an ask letter.

0 -

our org current practices:

- Luminate Online (main donation form) will eReceipt any donation that is fully deductible, so they will come into RE as Receipted already, EXCEPT for Recurring donation, they will always come into RE as Do Not Receipt, waiting for beginning of next year to be receipted all at once

- Other channel of giving (check, transfer, stock, etc) are receipted as they come in

- We have a eReceipt custom built using SKY API for all that has valid email

- Anything else is snail mailed

We are considering a more consolidated effort: Donor Statement, where we have all the donor's giving for the previous year in 1 letter (emailed if valid email, or snail mailed). Something to work out with finance: is it a replacement for all the individual receipt we sent, or in additions to it so donor have a better experience of 1 letter to take to their accountant rather than seeking out multiple receipts through out the year.

0 -

@Dariel Dixon, I was coming here to ask the same thing – particularly about IRA/QCD gifts.

First, we send to all donors who make multiple gifts throughout the year (recurring or frequent donors). We were just contacted by a donor who was upset that her IRA distribution was not included in her summary letter, though we sent an acknowledgment for that gift at the time.

Last year, @Lynne Stern asked how people are handling IRA/QCD gifts, but you were the only one who responded. I am wondering whether anyone's practices have changed in the past year.

We also want to ensure that these gifts should not be considered soft credits, since the money is theirs to distribute, versus gifts from donor-advised funds. How do organizations distinguish these kinds of gifts?

Thanks!

0 -

@Carrie Powell, I'm so glad to see you ask this part of the question yesterday as I've been meaning to type up my notes and this will help with that task. I was still exploring tools when @Dariel Dixon revived this thread.

In regards to IRA Rollovers/QCD, we do not include them as they already have received their tax benefits for those gifts.

In RE we enter these gifts with $0 in receipt amount and give them a gift subtype of IRA Rollover. We use gift attributes to track “Date (Stamped) Received” and “Firm/Bank” that we then populate in our thank you (not tax acknowledgement) along with a copy of their check.

We send statements to our sustainers (amount by fund) and those that gave multiple gifts (amount by gift date with the fund) and at least one gift over $250 (IRS 2022 Publication 526, pg19). We also do them on request (which seldom happens).

This year I looked at three different tools than the mail merge we have used in the past.

- The built-in canned report in database view | Financial Reports | Annual Statement Report

- Didn't end up using although it is customizable enough as we wanted email and not mail the statements.

- The Giving Statement in web view | available under fundraising -

- I was optimistic about this tool that we didn't use here my pros and cons

- Pros

- Appearance was good and has a lot of potential.

- The breakdown of commitments at the top.

- Fund totals at the bottom

- Disclaimer about amounts possibly not matching credit cards for gifts where Blackbaud Pays comes into play

- Ease

- Cons

- No control over the name format. This was a deal breaker for our organization for several reasons.

- Only 300 characters available for text on the PDF version - don't think it shows up at all on the email version (I may have missed something in the setup)

- Pros

- I was optimistic about this tool that we didn't use here my pros and cons

- Letter Box for the win!

- Appearance and ability to select columns we wanted

- Ability to personalize cover email with images and whatever text we wanted

- There was a typo in their form and they fixed it in a day (so if this was a road block for you it has been lifted)

- Ease of using gift list within web view to control which gifts to show

- These went out last week and all of the feedback from our donors was positive. They looked very individualized and could have been individualized further.

- Actions are on the records with the attachments and one-offs will be easy (I do need to export the actions and update them but that will take 10 minutes tops)

3 - The built-in canned report in database view | Financial Reports | Annual Statement Report

-

@Elizabeth Johnson, thank you so much for all the details! We haven't widely used the Giving Statements for the same reasons you outline, but we have found it helpful to use them in individual situations (especially when a donor's annual giving didn't meet the threshhold of receiving a EOY letter but they want some record).

After I posted the question yesterday, I did find this in IRS Publication 590-B:

“Also, you must have the same type of acknowledgment of your contribution that you would need to claim a deduction for a charitable contribution. See Substantiation Requirements in Pub. 526."

So, while donors do get a 1099 from their plan administrator when they make an IRA QCD, we are taking the above to mean that our organization still needs to provide the acknowledgment that we received the gift directly from the fund. (We generally do this at the time of the gift, rather than waiting for the year-end process, but this donor also wanted it in her summary statement.)

1 -

@Carrie Powell I think this is a difficult situation. I once saw someone describe QCD/RMD as “tax avoidance” or “tax mitigation” vehicles. I like that. With regard to adding the QCD on their tax summary document, I think that's a bad precedent to set. I would gladly reprint her original acknowledgement document. We do not give tax advice, and we should direct donors to contact the tax professional of their choice for that. But I don't like the idea of mixing full credit gifts and recognition gifts on one tax document.

@Elizabeth Johnson I think we all agree that the NXT Giving Statement is the most worthless addition ever. I have only seen one organization even consider using them.

2 -

I would really consider a yearly summary receipt @Alex Wong. It's helpful, but I really think these should be done upon request. There's no requirement to send them as long as a receipt was sent as part of the original transaction. They should never take the place of the original transaction.

0 -

@Elizabeth Johnson I'm interested in Letter Box for a client that is struggling with their acknowledgements and EOY giving statements. I connected the Letter Box plug-in but nothing happens when I select Bulk Letters or Templates (I do not get an Add or Create template button). I'm able to use the Settings Panel. Do you have any tips on what I may be doing wrong? I've contacted Red Arc support, but I thought you may have some insight on this. Thanks so much!

0 -

Hi there @Madeleine Holdsworth - does your client have the paid or free version? I had the free version and went to the paid version. It was a little while ago now, and I remember there was some fine print in the transition - something not to do - which, of course, I did. I'd recommend reaching out to their support - they are very responsive. Let us know how it goes!

0 -

Exciting that you're trying Letter Box @Madeleine Holdsworth !!

Our support team have actioned your request and I believe will be contacting you shortly as the resolution was straightforward.

Here if you have any more questions!

0 -

@Red Arc - Thank you! I received the email from your support team and it's working now!!!

1 -

@Elizabeth Johnson Red Arc support was able to get Letter Box working for me. I understand how to create the bulk leter and template, but I'm not seeing how you were able to send an EOY statement through Letter Box. I have a gift list but when I attempted the bulk letters as a test, it created one letter per gift per donor. How are you creating the EOY here? Any suggestion to point me in the right direction would be greatly appreciated!

0 -

So glad (and not surprised) that Red Arc's support was able to get you set up! And another chance for me to document more of my process!

I created a gift list in web view (started with just myself to test with as I'm a sustainer and a regular donor so lots of gifts to work with). I wanted to see one-time gifts, payments, and recurring gifts.

I created a template and made it look pretty and branded with our header logo.

I followed the layout of the web view's giving statements and added some merged fields.

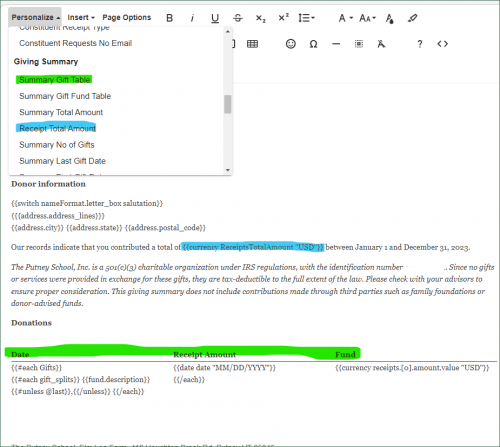

Here is a screenshot of my template for non-sustainers who gave multiple gifts that listed each gift individually.

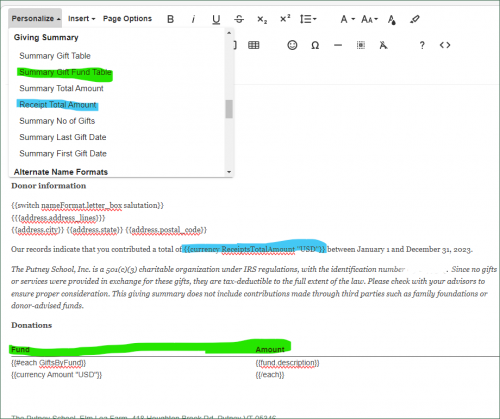

Here is a screenshot of my template for the sustainers that didn't list each gift but did subtotal by fund.

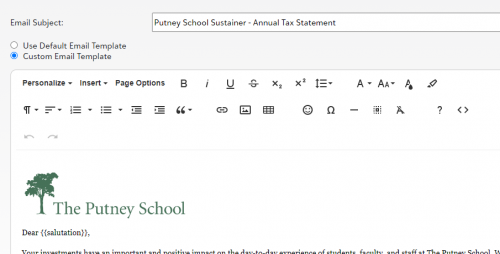

And a quick screenshot of the custom email template

Hope that helps!

1 -

@Elizabeth Johnson - That's how I imagined it should work. However, I don't get the Giving Summary fields in the Personalize drop-down. That's probably not available in the free version. Thanks for providing the screenshots though. I can show them to my client and perhaps they will want to get the paid version.

1 -

@Madeleine Holdsworth Just jumping in - we have an article here that tells you how to set up a giving summary letter. Feel free to reach out to us if you need more help and yes this feature is part of the Premium Plan.

1

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 21 Blackbaud Impact Edge™

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 124 Ninja Secret Society

- 32 Blackbaud Raiser's Edge NXT® Receipting EAP

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board