Importing data from payroll deductions from a report provided by Payroll Dept into RE

Our organization has multiple employee giving campaigns a year, so the monthly report is everchanging. How do others import payroll deductions? Do you consider these as recurring gifts? What are some of your best practices?

Comments

-

My org used to do Payroll via “Recurring Gifts” but it's a challenge to constantly keep up with employees who onboard/exit and/or increase/decrease their gift amounts. So when I came onboard I created an Import Template that I use to import the Employee Payroll Deductions each month. I receive an Excel spreadsheet of the Employee ID, Payroll Date (i.e. Gift Date), and Deduction Amount (Gift Amount). I copy and paste those columns into my template and then import the gifts. I also run a Financial Report when the import is complete to ensure the RE gifts total matches the Payroll Report.

3 -

I'm guessing you will hear a variety of options.

Options I've seen:

- A recurring batch with monthly gift amount all the employees, reviewed and committed monthly - gifts come through as cash.

- Pledges / recurring gifts (there is a difference IMO) put on employee records

- Recurring batch used to enter payments each month - gifts come in a pay-cash/pay recurring

- Using the auto-generate transaction function with a query of staff members to pull gifts due on a specific date - based on payment schedule for pledge /recurring gift. This will create your batch for review. Gifts come in as ‘pay.' Those who have completed their pledge are automatically no longer included in batch. This is my preference.

I personally prefer putting a pledge on employee record as this provides better reports - amount expected for a campaign, # of gifts more accurate than counting each monthly payment. Downside if you have high turnover is it requires record updating / pledge adjusting or write offs.

I trust other users will share their preferences. If you find you don't like one option, try a different one next time/year.

Best wishes.

3 -

I have used both options that @JoAnn Strommen has mentioned. I personally prefer the recurring batch instead of pledges which we currently use. If an employee is on leave or has no hours for that pay date, we have to go back in and write off that bi-weekly payment or write off pledge balance when the employee leaves. You would have to decide which option works best for your organization and what reports and projections on employee giving you would like to see. With

0 -

Which Financial Report do you use?

0 -

We set them up as recurring gifts and then use Importomatic to bring in the payments every two weeks. The file we get from payroll has their employee number, so we put that in the Gift ID field on the recurring gift. There is a setting in Importomatic that lets you use the Gift ID on a recurring gift to use the default values (most importantly for us, Fund). This works really well for us! We do get one-time gifts occasionally and those are processed separately.

0 -

Our payroll deductions are entered as pledges and then I set up a recurring batch once I receive the first deduction report from Payroll. It's not always seamless as sometimes our adjuncts come and go, or only work for a term, so I have to review the report and adjust the batch as needed. Overall it's been working for us.

1 -

I would look into a recurring batch. For certain. The method of import really depends on the file you receive from payroll. Some folks have a file that is easy to manipulate and easy for import. Some don't. I think that is the biggest determination between whether to do an import or a recurring batch.

In regards to recurring gifts vs pledges, I think that depends on if you have an end date on the deductions. At a previous position, the gifts were entered as recurring gifts unless an end date was entered and those gifts were entered as pledges. The issue that we would have is that we were never notified if an employee left the organization, so we would have to figure out when to terminate their recurring gifts/pledges many months later. However, we did have times when employees left and came back, and their deduction restarted again. shrug.

0 -

We enter employee campaign gifts as pledges. About 5 years ago I started creating an import file that I would send to payroll to use rather that entering everything into a recurring batch. This works really well for us considering we have people who do 1x payroll deductions, PTO payroll deductions and 26x payroll deductions and also many of those split their gift between funds. Payroll likes it and so do I. ?

0 -

We have hundreds of employees giving and don't use recurring gifts as it is a mess to keep up with terming staff, etc. I have recurring batches and payroll provides excel reports for each pay cycle with the employee ID, appeal code (we have three now), names, and deduction amounts. I use the employee IDs to compare it with the last report to add/delete from the batches. If the amounts still don't match, that means that someone changed their deduction amount, and I do a comparison for that in excel as well. I've tried other methods, and this is the most efficient process I found for our needs.

1 -

0

-

Dariel, How do you do a recurring batch if its not an EFT transaction, but a payroll deduction where we get the report at end of month? Do you set up recurring gift in each employee or is there a quick way to set up a “batch” with all the employees and have it recurring?

Thanks

Tiki

0 -

Sunshine,

Can you provide me with the steps you use to create a recurring batch? We receive notification only from Payroll each month that the employee has given. Do we have to go in each month to each individual record? OR is there an easier and less time consuming way?

Thanks

Tiki

0 -

Barbara,

I am new to recurring gifts and recurring batches. I have only ever used recurring gifts for EFT transactions. Can you tell me the steps I need to take to use for a payroll deduction? This is the first time we have ever “tracked” employee giving, so I need to set up the system/procedure correctly.

Thanks

Tiki

0 -

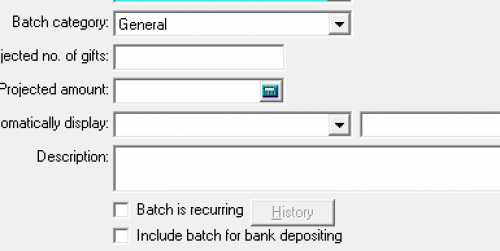

@Potique Johnson: This can be done on the gift batch setup.

Just because a batch is recurring doesn't have anything to do with having an EFT transaction. If you just create the batch as normal and set it to recurring, it just reduces the amount of gift entry. You'll still have to update the gift date and post dates and the like, but it can save a lot of time.Dariel, How do you do a recurring batch if its not an EFT transaction, but a payroll deduction where we get the report at end of month? Do you set up recurring gift in each employee or is there a quick way to set up a “batch” with all the employees and have it recurring?

Thanks

Tiki

1 -

@Potique Johnson

Our Gift Import File included the following fields:ConsID GFType GFSubType GFDate GFTAmt CampID FundID GFAppealID GFRef Acknowledge GFLtrCode GFRcpt GFRcptAmt GFPayMeth GFGiftCode GFCons GFPostDate GFPostStat GFAttrCat GFAttrDesc Most of those fields had default values so the only columns I had to copy/paste from the Payroll file was ConsID, GFTAmt, and GFDate.

That said, we no longer do this as a gift import! We have since created a Power Automate Workflow that automatically adds the Payroll Deductions to RE-NXT. I only have a very limited knowledge of how that process was created, so I'm no help at all on sharing that with you! ?

0 -

@Keith Wilson

Thank you so much!0 -

@Potique Johnson

I created the recurring batch first with all the gifts from the current pay period (many years ago). I reuse that batch every time. I save the report that payroll sends and do a comparison with their previous report in Excel to find what employees have been added/removed to update the batch. That's why the employee ID is important to have. I just do a quick conditional formatting between the ID columns to highlight unique IDs. If the total still doesn't match, I compare the amounts in Excel as well, but it is rare for the amount to change without us knowing first. I think there are several ways in Excel to do this, though.2 -

@Dariel Dixon

Thanks0 -

@JoAnn Strommen

Thank you0 -

@Sunshine Reinken Watson

This is what we do as well.1

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 21 Blackbaud Impact Edge™

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 124 Ninja Secret Society

- 32 Blackbaud Raiser's Edge NXT® Receipting EAP

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board