Gifts posted to deceased spouse need to be credited to living spouse

HELP!

Comments

-

Unfortunately, I don't think there is a particularly good solution here. If I'm understanding you correctly, I think what you might consider is using the Merge Constituent function to move all their gifts to Joanne's record. Then you'll need to go thru one-by-one (maybe Global Change, but I'm not sure) and update the Soft Credit Tab to soft credit John for gifts before 2000 and ensure there is no soft credit to John for gifts 2000 and after. Still a bit of manual work, but better than re-entering all of those gifts.

I would strongly recommend setting up two dummy records with this same problem exhibited by 3-4 gifts, and test out your "fix" before doing it on the actual records. Or ensure that a backup of your database has been recently made and alert your users to stay out for a period of time, just in case you have to restore a backup to fix an error. Merging constituents can be a tricky endeavor, in my experience. And Global Change can definitely do things in a way I would never have expected...1 -

If you're not skittish of doing imports, you could do the following:

- Grab all of the pertinent gifts via a query

- Export all data for each gift, including the constituent ID and the spouse constituent ID

- Globally delete the gifts in the query

- Import the gifts using the spouse's constituent ID as the constituent ID and the deceased's constituent ID as the soft credit ID

And definitely try this on some dummy records before you do it to the real deal.

Finally, you'll just need to create some system to ensure that new gifts are no longer put on the deceased's record.0 -

Addendum: duh, you probably don't want to soft credit the deceased for gifts made after he passed, so forget about exporting the deceased's constituent ID. Just export the spouse's ID with each record and use that to import the gifts onto her record.0

-

Just an additional note to prevent it from happening - You can create a business rule that would pop-up if you are entering a gift on a deceased person's record. You just need a query of all records marked as deceased and user rights to add a business rule. Can be helpful as long as data entry persons heed the pop up warning.0

-

"I'm not dead yet!"

One of those crazy side-effects of being named "John."

One of those crazy side-effects of being named "John."

Sounds like this is a good opportunity to get more votes for this suggestion for a future release of RE: http://rediscovery.uservoice.com/forums/137015-raiser-s-edge-discovery-topics/suggestions/3049364-allow-to-move-gift-to-another-record

0 -

Funnily, we just had a similar problem. We used a gift export to move the soft-credits to a dummy account, which was deleted (see https://kb.blackbaud.com/articles/Article/51526), and then used the merge function to move the gifts to the spouse's record.0

-

I have always advocated for a strong process around the changes that need to be made for deceasing a constituent record -- and one of the items that is frequently missed is turning off the auto-soft crediting between spouses when one has deceased.

What can help is periodic review of recently deceased records to make sure all the changes have been made correctly. Soft crediting is one of the more important things that should be checked.0 -

To address this sort of issue, I have a query set up to find relationships to deceased spoues and a saved global change that removes the "automatically soft credit" checkbox on the relationship record. I then just run this global change periodically (about once a week) to keep my records clean.

Here's my query parameters, if anyone is interested:- This Individual is the spouse = YES

- AND Individual Relation Deceased = YES

- AND Automatically soft credit this individual for gifts = YES

- [uncheck "include deceased constituents at the top]

- Automatically soft credit gifts: Replace Checked with Unchecked (or "add unchecked / overwrite existing value"

0 -

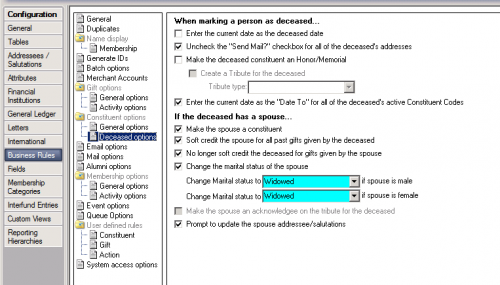

To prevent this happening in the future, you can actually have the system do a variety of things for you automatically when you mark a constituent as deceased. If you go to Config, Business Rules, Constituent Options, Deceased Options - you can choose to upgrade the spouse as a constituent, soft credit them for past gifts, and no longer apply soft credits to the deceased individual:

While this won't prevent someone from adding gifts to the deceased's record, you can do that with a User Defined Business Rule, like JoAnn suggested.0 -

See, I have the "no longer soft credit the deceased for gifts given by the spouse" checkbox checked, but it doesn't seem to work 100% of the time. I still get 1 or 2 records per week that get changed via the system I set up.0

-

I just have found that a manual check of deceased records to look for all the things that have to be changed will catch any anomalies. But we don't have a lot of deceased records to check on a regular basis so I can still do this manually ...

Also, don't forget divorced spouses as well, this soft credit selection also has to be turned off!

0 -

Yeah, my query actually has an OR ( ... ) section to identify those folks as well.

continued from previous query:- OR (This individual is the spouse = NO

- AND Automatically soft credit this indiviudal for gifts = YES

- AND individual relation Recip Relation Code one of: Spouse, Surviving Spouse, Former Spouse

- AND Indivudal relation code one of: spouse, surviving spouse, former spouse)

0 -

I ran Ryan's original query just to check our data. Pulled 0 records.

The reason it pulled 0 and that works for us in both cases of deceased and divorced is to uncheck the spouse box. We initially did this because we use many joint addressees/salutations and unchecking the box auto changed them to one name instead of the two. The relation/reciprocal fields can stay with spouse or be changed to former spouse for historic reference.

Just another thought...0 -

I put a pop-up message on deceased folks, so the gift processor (and I) will think twice before adding gifts on deceased records.0

-

That's interesting about unchecking the "spouse" box. See, we do this when do this (and we do) it doesn't automatically uncheck the "soft credit" box. Is there a business rule somewhere for this that I've overlooked?0

-

Since the spouse box is not checked they won't pull in the query so I'd need to adjust query to filter on relationship fields. For our org's purpose I'm not worried about a SC on a deceased spouse record if it does happen. Gifts posted to deceased person would be an issue, hence the business rule.

0

0 -

Oh, I see the point you were trying to make now

And your business rule for deceased constituents is very good. I can't honestly think of a time when a gift was errantly put on a deceased person's record here, but I think I'll create something similar just to be on the safe side.0 -

Ryan Hyde:

See, I have the "no longer soft credit the deceased for gifts given by the spouse" checkbox checked, but it doesn't seem to work 100% of the time. I still get 1 or 2 records per week that get changed via the system I set up.I may be mis-interpreting the way you're pulling your query, so apologies if I'm wrong! But, it looks like the query you're using is pulling any Individual relationship who is a spouse, and who has any other relationship to a deceased individual (not necessarily that their constituent spouse is deceased.) I have definitely made queries that don't quite do what I think they're doing - so you might do some checking on which relationships are being altered.

0 -

Ryan Hyde:

See, I have the "no longer soft credit the deceased for gifts given by the spouse" checkbox checked, but it doesn't seem to work 100% of the time. I still get 1 or 2 records per week that get changed via the system I set up.Could this could be because those were set up before the box was checked?

0 -

Maybe? But that seems like a poorly designed feature if it's contingent on when the records were created.0

-

Amy Matthews:

Ryan Hyde:

See, I have the "no longer soft credit the deceased for gifts given by the spouse" checkbox checked, but it doesn't seem to work 100% of the time. I still get 1 or 2 records per week that get changed via the system I set up.I may be mis-interpreting the way you're pulling your query, so apologies if I'm wrong! But, it looks like the query you're using is pulling any Individual relationship who is a spouse, and who has any other relationship to a deceased individual (not necessarily that their constituent spouse is deceased.) I have definitely made queries that don't quite do what I think they're doing - so you might do some checking on which relationships are being altered.I had a similar concern, so I extensively checked the records before I started executing any global changes. It seems that the query is smart enough to realize that I'm looking for one relationship that meets all criteria, not one constituent that has a set of relationships that meet those criteria in combination.

Anyone looking to model what I did should absolutely test and re-test before they execute a global change though! This is a totally valid concern!

0 -

How do I set up gifts to automically soft credit?Ryan Hyde:

To address this sort of issue, I have a query set up to find relationships to deceased spoues and a saved global change that removes the "automatically soft credit" checkbox on the relationship record. I then just run this global change periodically (about once a week) to keep my records clean.

Here's my query parameters, if anyone is interested:- This Individual is the spouse = YES

- AND Individual Relation Deceased = YES

- AND Automatically soft credit this individual for gifts = YES

- [uncheck "include deceased constituents at the top]

- Automatically soft credit gifts: Replace Checked with Unchecked (or "add unchecked / overwrite existing value"

0 -

How do I set up this business rule?JoAnn Strommen:

Just an additional note to prevent it from happening - You can create a business rule that would pop-up if you are entering a gift on a deceased person's record. You just need a query of all records marked as deceased and user rights to add a business rule. Can be helpful as long as data entry persons heed the pop up warning.0 -

If you are moving the gifts to the living spouse, I would simply merge all gifts from the deceased spouse to the living spouse and click the box to exclude soft credits. You don't have to merge the whole record - you can select to merge just the gifts. This means that you won't have to delete any history and it will take less time than exporting, etc. as suggested above.0

-

JoAnn Strommen:

Just an additional note to prevent it from happening - You can create a business rule that would pop-up if you are entering a gift on a deceased person's record. You just need a query of all records marked as deceased and user rights to add a business rule. Can be helpful as long as data entry persons heed the pop up warning.JoAnn - I have this set, but cannot not make it work in batch entry. Have you been able to do that? Do your offices use batch entry for gift entry?

Heather

0 -

Heather MacKenzie:

JoAnn Strommen:

Just an additional note to prevent it from happening - You can create a business rule that would pop-up if you are entering a gift on a deceased person's record. You just need a query of all records marked as deceased and user rights to add a business rule. Can be helpful as long as data entry persons heed the pop up warning.JoAnn - I have this set, but cannot not make it work in batch entry. Have you been able to do that? Do your offices use batch entry for gift entry?

HeatherIt needs to be set up as a Gift Business Rule, not a Constituent Business Rule for the alert to pop up when entering new gifts. I recently did this as a test when writing a response to another thread, and it worked in Batch. (Make sure that you've also selected the correct Security User Groups for the Rule).

1 -

All the notes on how to move the gifts are good, and if you have not yet voted on "move one gift" in the user voice please do.

We have a constitutent business rule pop up that alerts any RE user if they open a deceased record; hopefully this will alleviate any future data entry on a deceased record.

1

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board