Posting Sold/Unsold Stock to GL (FE Integration)

Hi Everyone!

First post, so not sure if this is the correct forum.

We integrated RE/FE (fairly) recently and we've hit a snag when it comes to posting stock gifts. I am on the Development Team and am responsible for posting gifts from RE to the GL in FE. Our Finance team only wants to post the proceeds of stock gifts but it looks like the integration requires that we post both the unsold and sold stock amounts. So I was wondering.

- Is there a work around that would allow us to “sell” the stock in RE and just post the sold amount? or

- Is there another way we can set up our GL accounts to account for the unsold amount? (I am not fluent in accounting but from what I can tell our GL distributions for the sold and unsold only debit/credit our cash/money market account and revenue account.)

Thanks in advance for your help!

Comments

-

Hi,

I have found this to be confusing for a lot of people, so hopefully I can articulate this well enough in a post.

The GL distribution is mapped on a Fund record. You do need to map each Fund separately though you can use “Copy From” on the GL distribution tab and copy from a template or an existing Fund. You do not need to map every gift type, and you can map the same gift type to different GLs if you also use Subtype. That probably won't be an issue here though.

One cause for confusion is that the gift types on the GL distribution tab are a little confusing compared to the Gift Types that we see on gift records. Almost every organization I've worked for or consulted with has sold stock immediately and only entered the value of the stock on a constituent's record. The gift type was always “Stock/Property”, and it was mapped to “Sale Stock/Property”.

If you want to add the stock when you receive it and then sell it “within” RE so that you can separate gain or loss and broker fees, you would enter it as "Stock/Property" first. When you sell it, you would open the Stock/Property gift record, then go to Gift | Sell Stock/Property on the menu bar. You add the sale amount, date, and broker fees (among other things I can't remember) and when you complete the sale, the gift type will change to “Stock/Property (Sold)”. If you have also mapped Stock/Property (Gain), Stock/Property (Loss), and Stock/Property Broker Fee, then the money will distribute to the proper GL accounts.

I hope that makes sense. I have only had one client ever do that, and they started the process while I was consulting there so I don't know how well it worked for them long term. As I mentioned, every other organization I've been with over the years has sold stock immediately upon receipt and just booked the final sale amount in RE.

Karen

2 -

@Karen Diener already gave an excellent answer, and so the only thing that I am going to add is how our Finance team deals with tracking the stock gain/loss when sold.

Because IRS requires us to value the stock on the day of transfer to our org, that number needs to be tracked in RE. Because Finance has ownership of our assets, they will sell the stock at their earliest convenience. But they own that part of the process, and only they care about the value of the sold stock, and so they track the gain/loss to an asset account. You might find a similar issue with fees in general - RE lists the full gift, but Finance needs to account for the fees. I'm sure that you could find a way for all the information to be in both systems, but you probably only need the gift information in RE and then the movement of those assets in FE.

3 -

Thanks for the detailed reply! We've gotten this far in our process, but where things get hazy is when I try to post the stock gift to the GL because we record both the value of the stock the day we receive it (unsold) and the value of the proceeds less fees (sold amount)

For example let's say a donor makes a stock gift today totaling $1,000 and our broker sells it the next day and for $990. I would:

- Record the $1,000 as the gift amount (for donor acknowledgement/reporting purposes)

- “Sell” the stock using the “sell stock” feature, recording the amount it sold for ($990) and the fees ($10).

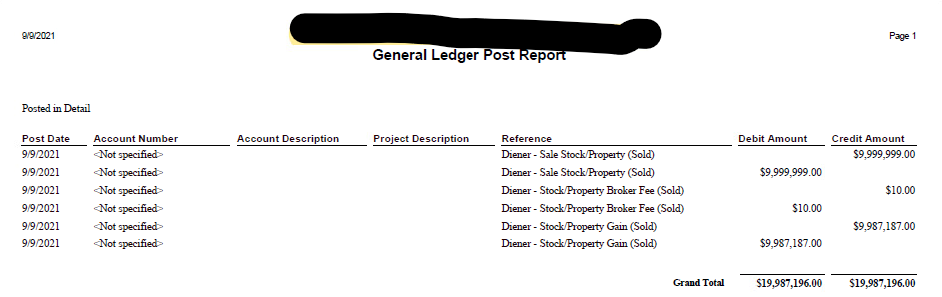

Then when I try to post the stock gift to the GL the post report shows the following entries for the same gift:

- $1,000 (for the unsold amount)

- $990 (sold amount)

- $10 (for loss)

- $10 (for fees)

Finance is good with the $990 and the loss/fees entries but they don't want the $1,000 posted to the GL. Not sure how to get around this unless we post the unsold amount to a different account? Again, I know next to nothing about accounting so it might not work that way ?

1 -

Yes, this is the way we do it too! I think we've figured out how to post the fee/loss information but RE is posting both the unsold amount (the gift amount we credit the donor) and the sold amount (the amount after gain/loss) as two separate entries to the GL. Not sure if that makes sense but I replied to @Karen Diener's post with an example.

Thanks for your time!

1 -

I think there are two options:

Mark the Stock/Property gift as “do not post” when you enter it. I tried this, sold it and added broker fees too. Even though the gift changes to “Stock/Property (Sold)” and the Post Status stays at “do not post”, I can view the sale information and it shows that it posted today.

Another option might be to NOT map the “Unsold Stock/Property” gift type. I might have misspoken in my first response about that mapping. The organizations I've worked with always mapped “Unsold Stock/Property” and entered the gift as “Stock/Property” because they did not do the sale in RE.

In my example, I failed to check mapping ahead of time and only did after I had posted the gift. The only gift type that was mapped was “Unsold Stock/Property”.

I think I lean toward the first option only, but don't have an integrated instance where I can test it fully. It seemed to work from the RE side, but I have no way of seeing it in FE.

Not a very methodical or complete test, but I hope it is helpful!

Karen

1 -

Thank you so much! I will give these a try. I really appreciate you taking the time to look into this.1

-

Speaking as an accountant this is what I would expect the GL post report to look like:

Recording of stock gift

1,000 Stock GL account Number

1,000 Donation Revenue GL Account Number

Recording of stock sale (per your specks)

980 Cash GL Account Number

10 Fees GL Account Number

10 Loss on Stock GL Account Number

1,000 Stock GL Account Number

My assumption is when you put in the sold amount RE calculates the gain/loss. If you add a fee amount, it will be netted with the gain/loss to calculate cash.

If you received $990 cash then you either had no fees or had no loss or had a gain and higher fees.

This is how an accountant would expect the GL post to look like.3 -

Thank you for providing an accountant's insight! If I am understanding correctly, it looks like you have a GL account for stocks that is separate from the GL account recording the cash received from the sale of those stocks. Our GL accounts aren't currently set up that way which may be one of the reasons we are trying to get around posting the unsold amount. Right now our stocks are recorded against a cash account.

I really appreciate seeing another way of setting up GL accounts that may be more aligned with how RE processes unsold/sold stocks.1 -

I think I was able to get option 1 to work! Now to see if Finance thinks it works ?

1

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 3 Blackbaud Staff Discussions

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board

Community All-Star

Community All-Star