Annual Statements with Benefits and Installment payments

Options

How do you do Annual Statement Receipts in RE? We also have a PBS TV Station at our University which is complicating the receipting process. Donations may be made in installment payments which exceed the benefit (premium) received and in some cases the value has not been captured until the next calendar year. As far as the premium being received, it sometimes is sent after first payment and sometimes half-way through and others (check payments) not until fully paid pledge even if the fair market value of the item has been recouped. The other complications include fundraising events, such as, golf tournaments, athletic auction to name a few; wherein, the donor is receiving a benefit and in some cases exceeds the donation which RE does not allow you to put on the benefits tab and it must go in gift attributes as an excessive benefit value. The canned reports do not work for us at all because it does not let you capture the information required by IRS laws that need to be provided and we are struggling as to how to do receipts since we moved to RE. Can anyone give suggestions and laws regarding benefit receipting with regards to installments and crossing calendar years? We are manually doing receipts since we moved into RE which takes many hours and especially since the data is hard to get out because of the many places it is located depending on the event, activity, value and KMOS benefits are located in packages.

ANY suggestions and assistance is greatly appreciated. I know that it is too late for this year but we need to get a handle on a way to do these more accurately and efficiently.

Thank you for your time and assistance.

Respectfully,

Judith

ANY suggestions and assistance is greatly appreciated. I know that it is too late for this year but we need to get a handle on a way to do these more accurately and efficiently.

Thank you for your time and assistance.

Respectfully,

Judith

Tagged:

0

Comments

-

Hi Judith-

You've got quite a few questions packed into this comment making it a little difficult to give a complete answer. It sounds like the issues you are trying to overcome include:

1. Payments may exceed benefits

2. Benefits may exceed payments

3. Gifts may not be captured until next calendar year

4. Timing the benefit is delivered

5. Canned report does not meet IRS requirements

6. Data for receipts spread across multiple locations in RE

Here are my initial thoughts:

1. If a gift exceeds the benefit, that constituent needs a tax receipt for the gift amount beyond the FMV of the benefit. You'll have to calculate that somehow seeing as you are tracking Benefit amount in a Gift Attribute. I recommend you start calculating this tax-deductible amount and store it in the Gift Receipt Amount field of the gift.

2. If the benefit exceeds the donation, you can include the donation amount in the year-end tax letter, but the tax-deductible amount is zero ($0). I would also start tracking this value in Gift Receipt Amount.

3. You can only receipt money that you have received within a given calendar year. If the gift isn't received/captured until the next calendar year, you should not include that gift in your year-end receipts.

4. If you deliver the benefit at different times for different people, this will absolutely complicate your receipting process. Legally the receipt needs to cover what really happened so if the donor has given gifts, but the benefit won't be sent until the next calendar year, that benefit should not be considered in the year-end receipt. If they already received the benefit, that should be evident in your tax receipt.

5. I don't use that report myself, but if you think the report does not meet IRS requirements, you are going to have to compile these receipts manually as you are doing now. There are many ways to approach this, but your gift entry procedure will dictate your receipt-building process. For example, if you allow constituents to split gifts across appeals and you use Gift Receipt Amount to show the deductible portion, although you can report out the Split amount, there is no such thing as a Split Receipt amount. You'll have to manually calculate that.

6. Only you can answer this question based on your own database structures.

Here is a description of my very time-consuming, overcomplicated year-end receipting process:

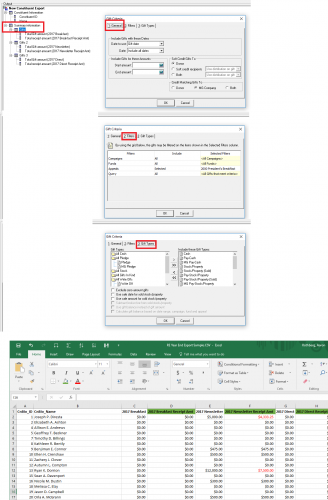

1. Use a Gift Query to find all appeals gifts were given to during a calendar year

2. Build a Constituent Export and include one gift column for each appeal you found in step 1 and place a summary in that column for that appeal constraining the gift dates to the calendar year making sure not to include pledges. This is important for us because we itemize gift receipts based on appeal codes.

3. Build a Constituent Query of all donors for that calendar year and run it through your Export. It will look something like the screenshot you see at the end of my comment.

4. Use that document for your Word merge. You can list column E, for example, as the gift amount and column F, as the tax-deductible portion.

How's that for a Clear-as-Mud answer?

EDIT: I just realized I did not include gift dates in my Export gift summaries so make sure to set those dates for the calendar year you are receipting.0 -

As far as benefits, I highly recommend using language that avoids telling any donor that any portion of their gift is tax deductible. You don't know their particular situation or what other factors may be in play. I prefer to say something like, "Your total giving for 2017 was $500. The fair market value of benefits received was $100. Please consult a tax professional on the deductibility of your charitable gifts."

When the FMV exceeds the Gift Amount, you can still use this language..."Your total giving for 2017 was $100. The fair market value of benefits received was $150. Please consult a tax professional on the deductibility of your charitable gifts."

In any case, you want to leave the math up to the donor...provide the necessary information but in no way give tax advice (instead of, "The tax-deductible portion of your gift is..." or "Your gift is 100% tax-deductible!").

This way, if you have a foundation or donor-advised fund gift slip through and get a receipt or statement, it won't matter because you're not stating that any part of the gift is deductible.4

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 3 Blackbaud Staff Discussions

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board