Soft Credits--How? Why?

Comments

-

Amy Ranker:

Hello all! I am new to data entry in general and Raiser's Edge in particular. I am responsible for gift entry and as we change over to RE, a question has come up as to why we have soft credits in our system and why they are needed. The way I have been using it is that we apply the gift to the donor and soft credit to what company/organization they are giving through. When I asked our consultant, she said that we should be doing it the other way around (soft crediting the individual donor) and that that was best practice. But why is that so? If we are doing it the second way, then when I pull gift reports, the donation shows up under United Way, for example, and not the person who actually gave the donation. So what are you doing?Hi Amy! We use Soft Credits to designate individuals who are not technically who we received the gift from, but should be given credit for it. In this case, it is pretty common practice to add the gift to the Company/Organization record since they are who wrote the check or sent in the donation. We soft credit the person who actually donated that gift through the company/organization to show their involvement. You are right that it appears under the Organization at that point, but we have the option in Query, Export, and Reports to give credit to the Donor, the Soft Credit Recipient, or Both. Raiser's Edge is built to be used in a number of ways. If your organization prefers to enter it the way you currently are then that is perfectly fine. I would just advise to be sure that that standard across all data entry personnel at the organization. I hope this helps!

3 -

It sounds like your consultant is correct.

Here's how I describe it:

Hard Credit Donors are the entities who are in control (own) the money before giving it to you. They are the entities that are legally able to give you the gift.

Soft Credit Donors are the entities who can be recognized as being instrumental in the gift, but they may not own the money before giving you a gift.

Think about the CEO of a company who sends your organization a gift. The company may send you a corporate check, so the company (legal entitty) gets the hard credit. They controlled the money before it was sent to you. The CEO, however, was instrumental in instructing the company to do so. She gets soft credit.

Another helpful hint: The hard credit donor is usually the entity that can deduct the gift on their taxes.

You want to be sure to keep proper track of hard credit and soft credit donors for auditing purposes, but also for reporting purposes. Are more of your gifts coming from individuals or foundations? Are you getting a lot of small gifts from individuals and large gifts from corporations? Or the other way around? Keeping careful track of hard credit donors will help you analyze your giving data...

To be fair, it's not always easy to tell who should be given hard credit and who should be given soft credit. I wrote about some of these challenges in a blog post about hard and soft credit. Things like donor advised funds (vs donor directed funds) make the hard credit/soft credit waters even murkier. Sometimes you need to do research beyond the name on the check to find out the full story about where a gift came from.

Amy Ranker:

Hello all! I am new to data entry in general and Raiser's Edge in particular. I am responsible for gift entry and as we change over to RE, a question has come up as to why we have soft credits in our system and why they are needed. The way I have been using it is that we apply the gift to the donor and soft credit to what company/organization they are giving through. When I asked our consultant, she said that we should be doing it the other way around (soft crediting the individual donor) and that that was best practice. But why is that so? If we are doing it the second way, then when I pull gift reports, the donation shows up under United Way, for example, and not the person who actually gave the donation. So what are you doing?

6 -

For us, SC does imply some ownership of the funds. One difference for us would be SC the CEO of a company strictly because they helped secure the gift. The CEO could possibly be credited for the gift as a solicitor. My interpretation of Tom's example is of a large company where the decision to give the money was not made just by the CEO.

Our hard/soft crediting between companies and individuals is more limited to if the individual is the primary owner of the company/agency. Ex: John Brown and the John Brown Insurance Agency or Sue White has an interior design company and some gifts come from personal account, others from her company. We SC in those cases.

And then we also use SC in situations where both spouses have records in RE. SC provide a more complete giving history record when pulling up either spouse - don't have to go to both records.

Amy, giving thru an organization can get messy. There are some orgs that are the legal donor and individual is SC. But, there are some orgs that are taking payroll deductions on behalf of the person and in those cases individual is HC and receipted by us. From what I've seen on the forums, all UW donations are not received or handled in the same way at all. As Tom said, who is the legal donor and gets the tax credit. For United Way, generally the individual is receipted by UW for their donation.

Best wishes in your new position and learning all about RE.1 -

You want to apply the gift to who gave your org the money, which in your example is United Way. UW is a nonprofit, so has already sent the donor their tax-deductible notice, so when your org gets the money, it's now a soft-credit to the donor. You would not have received this money if it wasn't for that donor, so you track that through soft-credits. Of course, it is still important to thank your donor, but you should not mention the tax deductibility aspect of their gift, as they should not get double credit. This is also true with Donor-Advised Funds. You can run reports on soft-credits. See the RE website.0

-

Totally agree with what everyone said (great explination Tom!)

Not sure if anyone addressed your comment about how hard creditting the org can screw up reports.

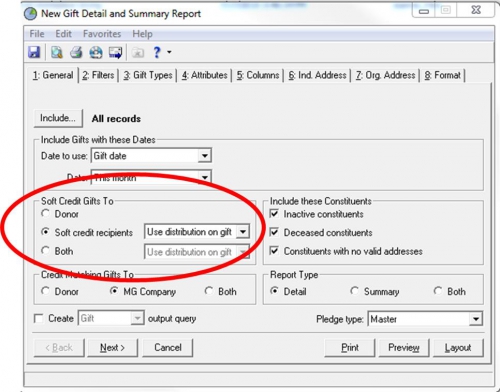

Depending on the report you can select to include soft credit donors (usually there is a portion that has text something like "Soft credit gifts to" and you can pick donor or soft credit recients or both - to exclude the org from the report select Soft credit recipient under that area and Use distribution on gift)

See photo below for what to look for/do:

1 -

Oh and we deal with a lot of soft credits here and I totally dispise them!0

-

We've been having this conversation as well lately. We hard credit a DAF or a corporation and then soft credit the individual. However, we are running into all sorts of problems when running reports where we want to see the names of the actual individual donors (to print in programs...etc) and not the name of the DAF...etc. When we ask the report to show only the soft credited donor, this mucks things up as well, as sometimes our system seems to automatically soft credit a spouse, and then the gift isn't show up at all. We've gotten around it by asking the report to show both the soft credited donor and the main donor (when we are not caring about using it for $ totals...just for names) and then deleting all the DAF and corporations. We actually just researched this a bit online to see how other orgs do it, and came across a presentation by Bill Connors at a BBCON, who basically said to always hard credit the individual (the opposite of what we do).Amy Ranker:

Hello all! I am new to data entry in general and Raiser's Edge in particular. I am responsible for gift entry and as we change over to RE, a question has come up as to why we have soft credits in our system and why they are needed. The way I have been using it is that we apply the gift to the donor and soft credit to what company/organization they are giving through. When I asked our consultant, she said that we should be doing it the other way around (soft crediting the individual donor) and that that was best practice. But why is that so? If we are doing it the second way, then when I pull gift reports, the donation shows up under United Way, for example, and not the person who actually gave the donation. So what are you doing?

Here are the notes we took:

Blackbaud Conference for Nonprofits: bbcon2013

Bill Connors CFRE, bCRE

Independent Consultant on

The Raiser’s Edge

SF, CA

Primary Purpose of RE- Fundraising - not gift entry, not receipting, not accounting

- Don’t let accounting dictate how RE is used

- Always think about the output – how best to report information to the fundraisers

Tax Receipts

To learn what tax receipts and acknowledgement letters should say: Look at IRS publication 1771- The IRS says nothing about what record a gift should be entered into in a fundraising database

- You do not need to enter the gift in a record based on the name of the check

- You do need to follow proper tax receipting and acknowledgment laws and rules, but do not need to follow a mindless “name on check” fallacy

Soft Credits- Don’t “just soft credit them”

- Consider the OUTPUT with soft credits, not just the input

- There are trade-offs – easy on the entry end or easy on the output end

- Do not use soft credits for

- Money raised

- To simply link someone to a gift

- Hard credit should go to the fundraising entity – who we asked, who gets the acknowledgment, who gets recognized, who gets further mailing, who will be asked again

- Create a gift attribute named “Name on Check” with a text data type

- Enter this attribute on any gift where the name on the check is sufficiently different from the donor’s name to warrant calling this out in the letter

- Include this attribute in the fields to export for the acknowledgment letters.

- Modify the acknowledgment letter to include this field and use the Microsoft Word “If … Then…Else … function to display the name on the check in the letter only if the attribute is not blank.

- There should be a very limited use of soft credits

- Use “other” as a gift type rather than soft credit

- Consider using gift subtype every time with Other to explain the specific uses of Other and to allow filtering of queries, reports, exports, and so forth more easily

Donor-advised Funds (DAF)- From non-profit community foundations

- From for-profit corporations

- Who is the gift legally from? Who gets the tax receipt credit?

- BUT

- Who made the decision?

- Who do you want to thank?

- Who are you going to recognize?

- Who are you going to mail to accordingly?

- Who are you going to ask for the next gift?

- In whose record does your fundraising team want to see the money?

- Hard credit the individual or couple who “advised” the gift

- Use the “Name on Check” gift attribute

- Soft credit the foundations, not the corporations

- Always with an eye toward your SC grid and output needs

- Ensure your acknowledgment letter is worded properly

- Have a DAF Letter code?

- Use conditional statements in your letters?

- Put the Name on Check attribute in your letter

- Create an organization relationship …

- To the DAF itself?

- A linked relationship to the foundation

- Anything to the corporation?

Employee Giving- It is common for the company or a third party to send us the employee contribution

- So it arrives on a company check, oftentimes with both the employee’s money and the company’s match rolled into one

- BUT whose money is it?

- The employee’s money should go into the employee’s record as a hard credit

- Use the Name on Check attribute

- The company can’t provide a tax receipt to the employee, so less concern about the acknowledgement letter addressing tax issues

- If you don’t know the employee’s name, use

- The Anonymous constituent

- An org constituent named “The Employees of ABC Corporation”

- Use the Matching Gift functionality, don’t use soft credits for matching gifts

- If both parts arrive in the same check

- Enter the one check as 2 cash gifts in the batch

- Create the Matching Gift Pledge off the employee’s portion

- After the batch is committed, apply the company’s portion to the MG Pledge

- Most organizations don’t post matching gift pledges, so a Cash gift and a MG Pay-Cash are posted the same way

- Depending on your post and reconcile with accounting, this may require some manual explanation

Family Foundations- Who gets the hard credit, is there a soft credit, are there organization relationships?

- Find out more information about the situation …

- If it’s the “glorified checking account” type, enter it into the person’s or couple’s record with the “Name on Check” attribute (don’t forget to do the letter right)

- If it’s the Gates Foundation, enter the gift into a record of that name and consider soft or Other credit based on your other uses of soft credit

- If it’s somewhere in between … that’s where judgment comes in – understand donor needs, and understand Raiser’s Edge

- Consider

- Are there foundation staff? A different contact person?

- Multiple people in the family beyond one couple, such as siblings or children?

- Is there a different mailing address?

- How is the recognition to be done?

Group Fundraising- People collect the money form their sponsors for us, and send in one check

- Gifts at the death of someone given to the surviving spouse

- Third Party events where we get the proceeds

- Who are the donors really? Who do we want to thank? Wo do we want to recognize?

- What does the IRS allow us to do?

- Pick up the phone, ask questions, get into complicated situations

- Break out the money into separate donor records if you can, and the data entry load is reasonable and worthwhile

- Otherwise enter the money into your “Anonymous” constituent record or another specific record to the purpose.

- Be careful with organizations – sometimes it IS there contribution

- Perhaps ask the host not to consolidate the checks

Revocable Living Trusts- A revocable living trust is set up by individuals and couples so their assets do not go through probate at death.

- It is a separate legal entity, but there is no separate tax entity (no separate tax id number)

- There are no staff

- There is no different address

- Giving decisions are not affected

- Fundraising is not affected

- Enter the checks into the Person/Couple’s constituent record

- Use the Name on Check attribute if concerned

- Don’t be afraid to ask your donors if you’re not sure – there are many kinds of “trusts”

Wrap Up Points- The IRS DOES NOT require the gift be entered based on the name on the check

- Understand and consider output considerations when entering gifts

- Document policies and procedures specific to your organization

Raiser’s Edge 8- Soft credits will be changed so you can run reports differently based on types of soft credits. For example, spouses with their own record you can tell the report to only report the hard credit (primary spouse). However, with foundations, you can have the report only pull the soft credit (the family). Right now, a report will treat all the soft credits the same way.

11 -

This is all great info! I am also new to a position in gift entry. I am working on determining "rules" for situations like this. I am leaning towards hard crediting individuals and soft crediting the DAF. My reasoning for doing this is primarily for reporting. Can anyone offer more insight into how they handle reporting accuretly when soft crediting indivdiuals who give through a DAF? I understand that you can choose to include soft credit donors in a report, but doesn't this misconstrue total amounts because gifts will be counted twice?

Also, if I were to go with hard crediting the individual and soft crediting the DAF, are there any remifications for sending an ackowledgement letter/ receipt to the individual if they were already receipted by the DAF. I'm concerned because that could potentially mean that they could claim a gift twice.

Thanks for your help!1 -

Wendy, if you search on the forums you will find lots of discussions about HC/SC, donor/DAF. It's done a lot of ways.

I'll address your second issue. No, you do not send a receipt to the individual. Most DAFs state that in their paperwork that comes with gift. You only send the individual a thank you. No tax statement and stating the amount is not done by everyone. A letter acknowledging that you recieved a gift at their request from a DAF and thanking them is not the same thing as a "receipt."3 -

Which direction the Soft Credit goes depending on what the gift is.Amy Ranker:

Hello all! I am new to data entry in general and Raiser's Edge in particular. I am responsible for gift entry and as we change over to RE, a question has come up as to why we have soft credits in our system and why they are needed. The way I have been using it is that we apply the gift to the donor and soft credit to what company/organization they are giving through. When I asked our consultant, she said that we should be doing it the other way around (soft crediting the individual donor) and that that was best practice. But why is that so? If we are doing it the second way, then when I pull gift reports, the donation shows up under United Way, for example, and not the person who actually gave the donation. So what are you doing?

1. If it is a gift from an individual that they are giving through their workplace giving program. Hard Credit the individual

2. If it is a Matching Gift -- matching a gift that an individual is making either through their workplace giving program or outside of that and then doing the paperwork to be matched, it is Hard Credited to the Company that is doing the matching and Soft Crediting the individual

3. If it is a gift from an individual through a Donor Advised fund - best practice is to record on the Matching Gift Company record and soft credit the individual0 -

Amy Ranker:

Hello all! I am new to data entry in general and Raiser's Edge in particular. I am responsible for gift entry and as we change over to RE, a question has come up as to why we have soft credits in our system and why they are needed. The way I have been using it is that we apply the gift to the donor and soft credit to what company/organization they are giving through. When I asked our consultant, she said that we should be doing it the other way around (soft crediting the individual donor) and that that was best practice. But why is that so? If we are doing it the second way, then when I pull gift reports, the donation shows up under United Way, for example, and not the person who actually gave the donation. So what are you doing?In my organization (and all the others I've worked in) we've always done it as the consultant suggested. The gift goes into wherever the check came from, they get the tax write off (in the case of foundations this isn't an issue but it's still done the same way) but the soft credit goes to whoever we should be crediting with the gift. For example, if a John Smith gave a gift of $500 through the John Smith Family Foundation the gift is entered on the foundation record and soft credited to him. So he's considered a $500 donor, it's just that his giving vehicle is not straight out of his pocket.

Make sure that whatever you decided you're consistent with it. Most queries/exports/reports give you the option of using the donor, recipient or both and if you've mixed the way you're coding these you won't get the information you're looking for. Also be careful if there is more than one soft credit person or if you want to report on both the donor and recipient. You'll be double counting $ if you use both and give them credit for the same amount. Continuing my above example, it was just a $500 gift, you don't want to pull a report that you use the option of both the donor and recipient and have them both credited for that $500.

0

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board