Soft credits and pledge payments - can you connect them?

Options

New to Raiser's Edge. If a pledge is created in an individual's record, but the payment(s) come from a DAF or other method so the individual is soft credited for the gift, is there a way to apply that soft credit gift payment toward the pledge in their record? I tried seaching the community but could not find an answer or solution to this.

If there is not, how do others handle/work around situations like this, since large pledges are usually paid off via third party methods. (securities, DAF's)

Thank you!

If there is not, how do others handle/work around situations like this, since large pledges are usually paid off via third party methods. (securities, DAF's)

Thank you!

Tagged:

0

Comments

-

If an individual's pledge is paid by a DAF, you will need to set procedures for your org to use. Generally if you read the statement/letter/check stub with a DAF payment, it says the payment can not be used to pay a pledge (benefit the individual). As the payment is from the DAF, it should be recorded on the DAF record. For informational purposes the individual is usually SC for the gift. Some orgs will delete the original pledge. Others adjust amount to $0 and in notations explain why so there a trail/documentation.

Most DAFs state they do not need to be receipted. As the individual donated the money to the DAF and received tax deduction at that time they also do not need a tax statement receipt. We just do a thank you without the tax statement or $0 amount included.

If the payment is from stocks or securities the individual gives to your org it's completely different. The individual is the donor and you can apply the amount against the pledge amount.

If you just type "DAF" in the search box, you should see a number of posts related to entering gifts from DAF. You may also want to check www.fundsvcs.org - lots of posts and info from very knowledgeable and experienced fund development people on do's and do not's.3 -

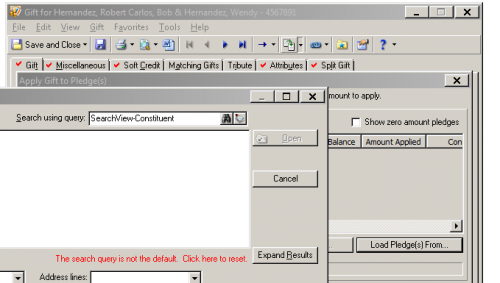

To apply a payment to a pledge that is on another record: open the payment gift > click the Apply To button (two white cards with a green arrow) > click [Load Pledge(s) From...] > search for the Constituent.

At my org, we are sometimes informed by a donor that they have requested a gift be sent from their DAF so we enter a Pledge as an intent or receivable, rather than a traditional pledge. Although, if we know it is coming from a DAF, we would probably enter that pledge on the DAF's record.

A former boss of mine, who was very knowledgeable about tax law, wrote our tax statements at that org to provide the value of the gift and the fair market value of any goods & services (rather than the "tax deductible amount"...let the donor do the math) and the statement, "Please consult your tax professional on the deductibility of your charitable gifts." This way, you don't have any need or responsibility to determine what the donor can or can't do on their taxes (because there are sometimes other factors at play, beyond what type of account is being used).4 -

Thank you both for your help!

0

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 3 Blackbaud Staff Discussions

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board

Community All-Star

Community All-Star