Applying Gifts to the Planned Gift Type

Comments

-

We keep all gifts on the original constituent record, with the reference reading made possible through....

We change the name of the trustee or executor on the main letter and add them as a relationship.

If by chance the gift needs to be sent elsewhere, we make a new record, link them through relationships and soft credit the deceased.1 -

We create a new separate constituent (org type) record for estates since an estate is a separate legal entity (according to the IRS), and we then link them via Relationships. The discussions we have had here (and I've had elsewhere) about converting the individual record to the estate record have mostly revolved around wanting the constituent's giving "all in one place" and on the same record so they can see previous giving. I've asked and I've never been given an answer as to "why?", especially after I remind them that the constituent has passed and, hopefully. will no longer be solicited or included in our moves management process.

If they want to see the gifts on the spouse's record then we soft credit the past gifts. An org record also allows for the entry of and mailing to related contacts such as attorneys and executors.

If they want to see the gifts on the spouse's record then we soft credit the past gifts. An org record also allows for the entry of and mailing to related contacts such as attorneys and executors.

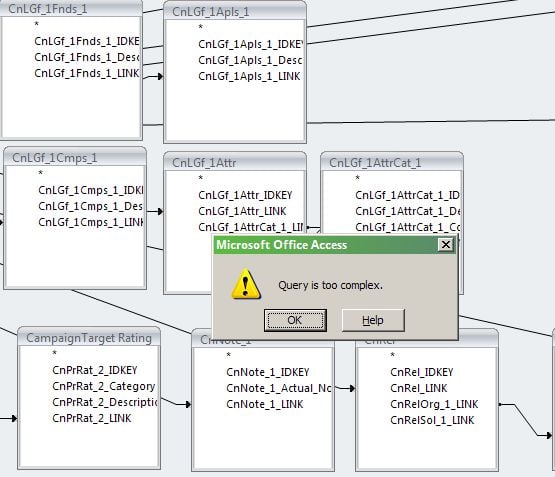

We also found out (after purchasing the module) that a Planned Gift, er, gift (i.e. bequest) cannot be applied to a Planned Gift on another record. We still stick with the above policies and just mark the Planned Gift as realized on the individual's record.5 -

We also use the Planned Gift module and found the limitation of only using a single constituent pretty annoying. We put the planned gift on the individual record when the person is still alive.

Once the person passes away and we receive a gift from the estate we create a new Estate record, re-create the planned gift (with the original date) on the Estate record and then process the payment. We also create a relationship between the Estate record and individual record (we use "Estate" and "Estate Namesake" for the relationship types)...

Be really, really careful with planned gifts. We like Raiser's Edge, but we really think Blackbaud messed this one up pretty good. It's nearly impossible to count Planned Gifts as "pledges" and realized gifts in as "payments" on most standard reports. This means it's real easy to double-count things when you're looking at a 5 or 10 year period of income.

Example: Let's say you're looking at "committed" money in (pledges and outright gifts...no payments). If you just query on the gift types you might get a Planned Gift for $100,000 as well as the outright Cash gift of $100,000. That adds up to $200k, when you really only have half that. You have to remember to only grab Cash gifts that are "not linked to a Planned Gift" in this example, though in some tallies screens you really can't factor those out.

Good luck!3 -

Thomas - I thought the planned gifts went in with a gift type of 'planned gift' so wouldn't those be extractable in your gift reporting?0

-

Unfortunately, we do not have the planned gift module so "planned gift" as gift type is not available.

I thought of entering as gift type of "other" on the individual record and creating a new gift sub type of planned gift or DAF. When funds actually received they would be entered on DAF record with soft credit to individual. Thoughts?0 -

Planned Gifts do go in as "Planned Gifts" but we also count that as a committment, so they're the same as a pledge. We will often include Planned Gifts with pledges in our reporting. When you're counting "committed" money you generally will add up all outright gifts as well as all committments.

The problem is that payment against Planned Gifts are sees in RE as "Cash" not "Payments"....2 -

Thomas Klimchak:

We also use the Planned Gift module and found the limitation of only using a single constituent pretty annoying. We put the planned gift on the individual record when the person is still alive.

Once the person passes away and we receive a gift from the estate we create a new Estate record, re-create the planned gift (with the original date) on the Estate record and then process the payment. We also create a relationship between the Estate record and individual record (we use "Estate" and "Estate Namesake" for the relationship types)...

Be really, really careful with planned gifts. We like Raiser's Edge, but we really think Blackbaud messed this one up pretty good. It's nearly impossible to count Planned Gifts as "pledges" and realized gifts in as "payments" on most standard reports. This means it's real easy to double-count things when you're looking at a 5 or 10 year period of income.

Example: Let's say you're looking at "committed" money in (pledges and outright gifts...no payments). If you just query on the gift types you might get a Planned Gift for $100,000 as well as the outright Cash gift of $100,000. That adds up to $200k, when you really only have half that. You have to remember to only grab Cash gifts that are "not linked to a Planned Gift" in this example, though in some tallies screens you really can't factor those out.

Good luck!

This is exactly what I was complaining about yesterday. At this point, I'm so used to reporting by dumping everything out of RE and calculating things myself, that I didn't notice there was a "total realized" field I could export to avoid double counting.0 -

Currently, our organization creates a "planned gift" (using the planned giving module) on a constituent record when they indicate that they would like to make a gift. This doesn't mean we will ever get any money. Neither does a letter of intent for that matter.

It's our policy that an "individual" makes gifts and can alert us to a planned gift, but we create organizational records for the actual estate when the money comes in. We don't want to make estate records until an individual dies - so we don't put the planned gift on the estate record we put it on the individual. Like I said, you never really know if you'll get any money, so why make the records until you need them? But when the money comes in we can't apply it to the individual's planned gift.

I don't like converting the individual to an organization because I think you lose the history. We also don't like to create the estate record for the purpose of recording the planned gift, becuase it leads to confusion. Lots of "Is he dead?!?!" calls.

It's a problem.

http://rediscovery.uservoice.com/forums/137015-raiser-s-edge-discovery-topics/suggestions/3013162-need-to-be-able-to-apply-gift-to-a-planned-gift-on0 -

Thomas Klimchak:

Planned Gifts do go in as "Planned Gifts" but we also count that as a committment, so they're the same as a pledge. We will often include Planned Gifts with pledges in our reporting. When you're counting "committed" money you generally will add up all outright gifts as well as all committments.

The problem is that payment against Planned Gifts are sees in RE as "Cash" not "Payments"....Thomas,

We are doing the same process here with the Individual constituent having the Planned Gift and once deceased the Estate of constituent record is created with the Realized Bequest cash gift. Have you ever come across the situation where the Planned Gift was higher (250K) than the actual Realized Bequest(45K)? How did you make the adjustment? We added the 45K gift to the "Estate of ..." as a cash gift but back in 2014 we have Expected Bequest with 250K in reports.

Thanks,

Kathi

0 -

Sorry for the slow response... Yes, we have had large planned gifts that ended up being a lot smaller when they were actually realized. We don't have a lot of them, but in the few cases where it's happened we ended up revising the original Planned Gift record downward so match the actual realized amount.

The same sort of problem can happen when you are counting Pledges as "committed" money and then someone passes away or says they won't pay off their pledge. You can write off the balance, but that doesn't change the original pledge (committed) amount... The original pledge amount is still there as a "committed" number even though you know you're never going to receive the money.0 -

Is anyone 'realizing' the planned gift on the original Planned Gift (on the deceased record), and then soft crediting the Estate record? Thank you!0

-

Thomas,

Thanks for your response. We can’t

change the PG due to our processes. We need to make an

adjustment in the current fiscal year showing a decrease in the

Planned Gift column of our reports. We decided to change our

business process with Planned Gifts to create the Estate record

when a PG is accepted and then once the individual passes and we

receive the gift, we link the received gift to the PG and we get

the Total Realized which can be used to calculate the

adjustment.It seems a bit dramatic to have to make this

business process change but in the long run it seems to give us the

amounts we need for reporting.Thanks,

Kathi

Kathi

McKelveyVoice:

520-621-1939

1111 N Cherry Ave, Room 305

Tucson, AZ 85721-01090 -

Hi Erika,

No we can’t change the PG on the individual

because it has been reported in previous year’s Campaign

report. Since we put the actual gift received on the Estate

record we can’t link the received gift to the PG to get Total

Realized. Thanks for your response. We need to make an

adjustment in the current fiscal year showing a decrease in the

Planned Gift column of our reports. We decided to change our

business process with Planned Gifts to create the Estate record

when a PG is accepted and then once the individual passes and we

receive the gift, we link the received gift to the PG and we get

the Total Realized which can be used to calculate the

adjustment.It seems a bit dramatic to have to make this

business process change but in the long run it seems to give us the

amounts we need for reporting.Thanks,

Kathi

Kathi

McKelveyVoice:

520-621-1939

1111 N Cherry Ave, Room 305

Tucson, AZ 85721-01090

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board