Tax deductible portion for a ticket sale

Hi there. I am reaching out to ask if someone can please educate me on this topic. I am not the events person at our organization so I don't dabble in the events module. Nor, am I the one who sets up a donation page for an event. Therefore, I am a little (actually a lot) lost on this.

Our organization is having a Christmas concert and offering sponsorship tables as well as individual tickets sales. A portion of the sponsor table and individual ticket is tax deductible. Here's where my job comes in and where I am lost. I do not see the ticket sales. I don't know where that is going. But yet, I am responsible for entering the tax deductible portion of the ticket sales to the constituent record.

I have 2 questions.

- what is the best/easiest/most efficient way to enter the tax deductible portion on the constituent record.

- in the future (obviously this event sale is already live) is there a better way to go about selling tickets to events where the ticket sales and tax deductible portion is recorded automatically on the constituent record? Or, any other suggested way is appreciated.

I have done the manual entering way too many times and looking for a solution to present to the other parties involved.

Thank you!

Comments

-

@Jolynn Uyehara I think we need to start at the beginning to understand the process up until the point it reaches you.

I assume people can purchase tickets and tables online or offline. What is the tool you are using for the online component?0 -

Hi, @Jolynn Uyehara. @Karen Diener's question is the starting question. Are your online registrations coming in thru OLX, NetC, or NXT? If they are, then the event fees are set up in the event creation step.

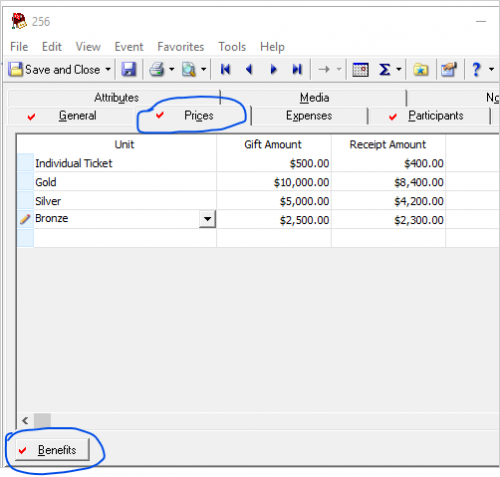

This screenshot from db is for an event we have. Ticket price: $500/person. Charitable portion: $400. This one doesn't have table option but fee and benefit easily computed. For each ‘unit’ of the event, enter unit name and then click ‘benefits’ at the bottom to enter the two $ figures.

Note, it is functioning as designed but it will list full gift amount on person's record and in all giving reports, unless it's one where you can use receipt amount. If you only want the ‘receipt’ amount on donor records, it's manual.

0

0 -

@Karen Diener @JoAnn Strommen Thank you for your feedback. This is a challenging one for me as I really have no clue what happens prior until it reaches my area. For this particular event, it's being handled by so many different departments, but I was just informed that regular ticket sales are being done through Eventbrite. Sponsorship tables and special donor tables are through our advancement office. The donors for the sponsorship tables are going to our website's giving page to make their payment and this is where I'm not sure how to handle it because it looks like a donation. Is there a way for me to separate the tax deductible amount on the constituent record?

0 -

@Karen Diener @JoAnn Strommen Thank you for your feedback. This is a challenging one for me as I really have no clue what happens prior until it reaches my area. For this particular event, it's being handled by so many different departments, but I was just informed that regular ticket sales are being done through Eventbrite. Sponsorship tables and special donor tables are through our advancement office. The donors for the sponsorship tables are going to our website's giving page to make their payment and this is where I'm not sure how to handle it because it looks like a donation. Is there a way for me to separate the tax deductible amount on the constituent record?

Eventbrite reports should indicate a tax deductible portion if it was set up correctly. It may also have fees removed for each transaction as well - again, it depends on how that was set up.

Sponsorship table payment via a donation page makes me nervous. There is typically no way to indicate a tax deductible portion, so chances are pretty high that people are receiving a thank you for their donation, and no tax deductible amount is specified.

On a gift record in RE, there is a Receipt Amount field that could be populated to reflect the donor's tax deductible portion. You can thank them for their $1,000 gift, $900 of which (for example) is tax deductible.0 -

@Karen Diener Thank you Karen. I will probably need to do it that way where the acknowledgement letter will state the amount and then the tax deductible portion.

I agree that having them pay through the giving site was not the best idea and this is where I wish they included me in the conversations but I guess I'm here now to clean up the damage. ?

Apprecaite your help!! ?

0 -

… this is where I wish they included me in the conversations but I guess I'm here now to clean up the damage. ?

I have definitely been there before! Bringing in new software, changes procedures, changing software - you name it! Hopefully everyone can reflect on this and use it as a learning experience to appreciate what is NOT a best practice!

Good luck!

1 -

@Jolynn Uyehara Do you have the event module? To work with sponsorship gift/benefit we have sponsors make payment on an event registration page. The auto ereceipt does not have a gift/tax statement, just $ was paid. Then we process these into RE and send a hardcopy receipt stating amount paid, benefit value and what can be considered charitable deduction.

This has helped our process but still has issue of RE gift amount shows full amount but it's linked to benefit.

1 -

@Jolynn Uyehara

We use RE Event module and Online Express for registration. Eventually when BB fix all the issue that affect how we do event, we will start using RE NXT event registration.Our org does not care if gift is entered for event registration ticket/sponsorship. At the end of the day, gift record = what donor “gave” to our org, regardless of how and for what. this money needs to be recorded in RE so that it post to FE (or any financial system you use) as it needs to reconcile with the bank as well as accounted for in gov/tax form

I do hear the “issue” of “first real gift” and how much did donor actually donate, that's reporting, but custom reporting is generally what you need to do, either through exporting from RE (database view for now) and then generate report using visualization tool (i.e. power bi, tableau, etc), or just excel pivot and/or excel formula. That's where you can account for and tranform gift to you liking/org policy on fundraising report

0 -

@JoAnn Strommen Hi JoAnn! We do have the event module which our events coordinator uses. BUT, she hasn't used it for that purpose. She's new and is learning and I keep encouraging her to sign up for the events courses that will be helpful. Hopefully we will be able to utilize the event module to help us streamline some of the process!

0

Categories

- All Categories

- 2 Blackbaud Community Help

- High Education Program Advisory Group (HE PAG)

- BBCRM PAG Discussions

- Luminate CRM DC Users Group

- DC Luminate CRM Users Group

- Luminate PAG

- 186 bbcon®

- 1.4K Blackbaud Altru®

- 389 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- 14 donorCentrics®

- 355 Blackbaud eTapestry®

- 2.4K Blackbaud Financial Edge NXT®

- 616 Blackbaud Grantmaking™

- 542 Blackbaud Education Management Solutions for Higher Education

- 3.1K Blackbaud Education Management Solutions for K-12 Schools

- 909 Blackbaud Luminate Online® and Blackbaud TeamRaiser®

- 207 JustGiving® from Blackbaud®

- 6.2K Blackbaud Raiser's Edge NXT®

- 3.5K SKY Developer

- 236 ResearchPoint™

- 116 Blackbaud Tuition Management™

- 160 Organizational Best Practices

- 232 The Tap (Just for Fun)

- 30 Blackbaud Community Challenges

- Blackbaud Consultant’s Community

- 18 PowerUp Challenges

- 3 Raiser's Edge NXT PowerUp Challenge: Gift Management

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 3 Raiser's Edge NXT PowerUp Challenge: Home Page

- 4 Raiser's Edge NXT PowerUp Challenge: Standard Reports

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 71 Blackbaud Community All-Stars Discussions

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- 743 Community News

- 2.8K Jobs Board

- Community Help Blogs

- 52 Blackbaud SKY® Reporting Announcements

- Blackbaud Consultant’s Community

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- Blackbaud Francophone Group

- Blackbaud Community™ Discussions

- Blackbaud Francophone Group