Spousal Records and Deceased Donors in RE

Options

I work in Estate Administration so I spend a lot of time thinking about how we handle deceased donors in Raiser's Edge. I am new at my organization and I’ve noticed something that has caused me some concern: when we receive notification that a donor has passed away, the record is marked as deceased regardless of if there is a spouse on the record. Consequently, the spouse is no longer receiving any communication (appeals or otherwise), solicitation, or stewardship anymore.

I've been discussing this at length with our IT team and we've come up with a couple of options but we're not sure which is the best approach.

1) Swap the spouses on the record so the living spouse is now the main constituent. However, we’re concerned with this causing tax receipt issues since the living donor could request that the tax receipts be reissued in their name. I intend to reach out to the Canadian Revenue Agency to get more information.

2) Create a second record for the living spouse and move all the pertinent information (address, cons codes, appeals, attributes, notes, actions, proposals) from the main/deceased record into the spouse’s record. Gifts would to be soft credited. This gets around the tax receipt issue but it means that we no longer have the history in the deceased’s record.

I’m very interested to hear what other organizations have done and if there is an industry best practice for how to handle these situations.

I've been discussing this at length with our IT team and we've come up with a couple of options but we're not sure which is the best approach.

1) Swap the spouses on the record so the living spouse is now the main constituent. However, we’re concerned with this causing tax receipt issues since the living donor could request that the tax receipts be reissued in their name. I intend to reach out to the Canadian Revenue Agency to get more information.

2) Create a second record for the living spouse and move all the pertinent information (address, cons codes, appeals, attributes, notes, actions, proposals) from the main/deceased record into the spouse’s record. Gifts would to be soft credited. This gets around the tax receipt issue but it means that we no longer have the history in the deceased’s record.

I’m very interested to hear what other organizations have done and if there is an industry best practice for how to handle these situations.

Tagged:

0

Comments

-

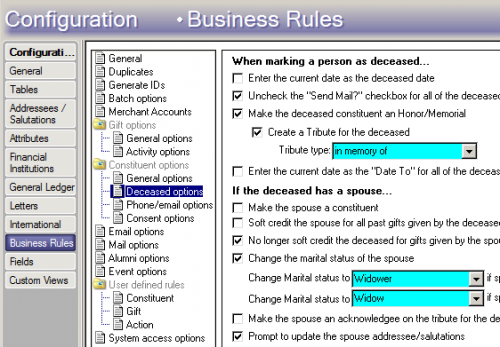

#2. And be sure to go to Config>Business Rules>Deceased Options to automate some of this process.5

-

We have been working to streamline this process too. We start a new record for the surviving spouse, unless they are also an alumni in which case they would have a separate record. The constituency code we use is Surviving Spouse. We merge records with caution. Relationships aren't accurately transferable so take some time.

As Katherine suggested, some of this can be automated. I'm eager to hear other suggestions too. Good luck!2 -

I would create a new record. I don't know if I would move everything to the new record. Obviously, soft credits for historical gifts, but I think moving everything over creates a false narrative. Generally speaking, there's the primary donor who has the affinity and the history with the organization. I don't know if moving over older appeals or attributes makes sense. And definitely not all the cons codes. Only those that apply. I'd keep a relationship to the deceased record that has the historical information, but I disagree that everything needs to be moved over to the new record for the spouse.

9 -

I agree that it makes sense to personalize the spousal record if you have an existing relationship with one or both of the couple but a lot of these are cases of DM donors. If we only move a small amount of the data over, then they probably wouldn't fall in the same data set. I think that's my biggest concern.

How would you handle those situations?0 -

I think it depends on how the data is being grouped. If the main criteria is giving, and if the soft credits are in, the spousal record should pull as long as you have included soft credits in the query options. If the criteria is something else, I'd consider adding the missing code/attribute/whatever. Obviously, volume would be a factor as well.

But your concern is more than valid. Obviously, you know your data better than anyone, any making sure that those spousal records is included in the data set is paramount.0 -

In that case, we would make the spouse a constituent and give them a solicit code of "mail to" which includes them in our mailings.0

-

Adriana -

I've done it both ways, depending upon the organization with which I'm working. My preferred way is to swap the spouses, but I'm a fan of fewer records. The surviving spouse didn't start giving when the first spouse passed away and most spouses give together. I'll add - that typically schools with records for alumni are the typical exceptions to this. I don't think, in using RE since 1997, I've every had an issue with a surviving spouse requesting a tax receipt without all giving recorded on it.

2 -

We swap the spouses. In Canada, a charitable tax receipt can be used by both donors, so if the main constituent dies, then either his living spouse or his estate can use the charitable tax receipt. It can also be split between the living spouse and the estate. As long as the gift was made before the constituent died. So, for us, this is the only way we record deceased persons. This allows for the living donor to continue to receive mail without the deceased person's name on the mailing.1

-

We have two scenarios - 1 - both spouses are constituents and either they give separately or as a couple (meaning 1 is soft credited). If a spouse dies, we mark the record as deceased and make the surviving spouse the "head of household".

2 - a constituent dies and the spouse is not a constituent - you can add the non-constituent as a constituent by opening the spouse link and going to the relationship tab and using the add this individual as a constituent. The addressing information and any other information you have on the individual's relationship record will populate to the constituent record.

You will only see the very basic information on the "new" constituent record.

I use the system to make changes automatically when a constituent's record is marked as deceased. This helps a great deal in not forgetting to make necessary changes to addressee information.

3 -

Hi! I vote for #2, and agree with what was mentioned before about picking and choosing what goes to the new record.

I create a new record for the surviving spouse, and use the business rules for deceased record processing (as mentioned previously) to automate many of the tasks. I then use the constituent merge tool to merge SOME information over to the surviving spouse's record (i.e things that we need to retain, but not necessarily on the decedent's record). However, that merge tool removes the information from the decedent's record, so, since I want to keep a history on the decedent's record for historical tracking, some information has to be exported/imported (essentially "copied to" the new spouse record) using export and then ImportOmatic. An example of something I merge over is appeals (rationale is, these appeals applied to the couple when they shared a record, I no longer need to know how we appealed to the decedent, but I definitely want to know how we appealed to the surviving spouse, because we use appeal history to inform future appeal segmentation, i.e are they an individual who traditionally gives in response to an end-of-year appeal). An example of something I export/import is Notes, which usually need to be retained on both records.0 -

I also vote for #2 with moving selected data to spouse record. I know some orgs choose to swap names but in my experience that really messes up some types of data like board/committee service, interests, education, business etc. So much cleaner to use deceased options to create a new record for spouse if they do not have one and move/copy the info desired.1

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board