Stock Gifts

We are perplexed on entering stock gifts in RE they are not coming over right to FE. So a few questions as I don't think we are doing it correcly. We have been entering the stock gift with the date we receive it, hitting save and then putting the sale in then posting. It am wondering if this is messing up the FE posting. Our accounts are not balancing. This may be a two party question, RE and FE, but maybe someone works closely enough like we do that you might have the answers.

1. When you receive a stock gift, do you enter it and post it? THEN when you sell it post that?

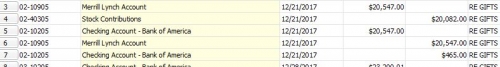

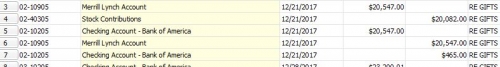

We are finding that the gains/losses are not posting correctly in FE. Is it the way we are posting or how we have the accounts set up for the funds? We have tried so many different ways. As you can see, when the stock gift was made and on Dec. 21 the money is debiting into the Merrill Lynch Acct and crediting Stocks. The problem here is that we received the stock on 12/21 and we sold iton 1/8 which is the date we put into RE. BUT for some reason (maybe because we entered the gift and sale on the same day THEN posted) it isn't hitting the accounts correctly. We wrote the check from ML for $20,082 and the $465 should stay in the ML account as a gain. But when you look they cancel each other out and the gain doesn't stay in the account. The credit of $465 to the checking account is correct so that our deposit is correct, but we aren't seeing the gain stay in the ML account. Is this because we should post the sale first before we sell it? SOOO confused and my Finance Manager is going nuts trying to get her accounts to balance.

Thank you so much for your help!

Michele

Comments

-

Hi

I can’t tell, but does RE have the GL accounts for brokerage fees and gain/loss set up for when you sell the stock?

Thanks

Ann

Sent from my iPhone

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-01.jpg]

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-02.jpg]

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-03.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-07.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-04.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-05.jpg]

0 -

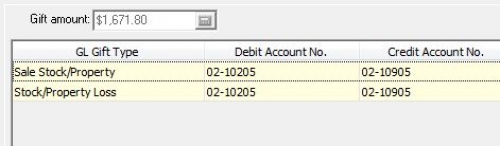

So when you go to the Records/ Fund/ GL Distributions you should have the highlighted accounts, see attached.

I guess you know this, but just in case - you can check the distribution of the gift before actually posting to the GL under View/View GL distribution in the gift record.

2 -

In addition to what Ann mentioned about having all the GL fund links needed are present for that fund.

I know once I forgot to 'sell' the stock and finance asked me to go in and mark it sold so it would list as they needed.0 -

Ann Pennant:

Hi

I can’t tell, but does RE have the GL accounts for brokerage fees and gain/loss set up for when you sell the stock?

Thanks

Ann

Sent from my iPhone

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-01.jpg]

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-02.jpg]

[https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-03.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-07.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-04.jpg] [https://www.pearsoncollege.ca/wp-content/uploads/Email-Signature-v3-05.jpg]Hi Ann -

Thanks for your response. It looks lie there is a Sale Stock/Property and a Stock/Property Gain or Loss line.

Michele

0 -

JoAnn Strommen:

In addition to what Ann mentioned about having all the GL fund links needed are present for that fund.

I know once I forgot to 'sell' the stock and finance asked me to go in and mark it sold so it would list as they needed.JoAnn -

Do you post the sale first then sell it and post that?

0 -

Cathleen Mai:

So when you go to the Records/ Fund/ GL Distributions you should have the highlighted accounts, see attached.

I guess you know this, but just in case - you can check the distribution of the gift before actually posting to the GL under View/View GL distribution in the gift record.Just checked - we have our accounts set up just like this.

0 -

Michele, I don't do the posting - finance does but I would say that the posting is all done at once. I enter the gift and 'sell' it two minutes later. When finance posts it is just one process.0

-

JoAnn Strommen:

Michele, I don't do the posting - finance does but I would say that the posting is all done at once. I enter the gift and 'sell' it two minutes later. When finance posts it is just one process.Thank you. We used to get the stock and have the broker sell it immediately. Evidently that has changed but not sure why. But it would be so much easier to just do that and then we won't be dealing with the gains/losses that seems to be messing up in FE.

1 -

Yes, our broker sells it immediately. When I said I sell it, I mean the process of changing it from a stock/property gift to a stock/property sold.

With a volatile stock market there can be and often are some gains/losses from the time our broker gets the gift from the donor and sells it for us.0 -

Sorry for all the questions. So when you sell it immediately, you always put in the same sold price? And then do you just have the finance department record the gain/loss on the FE side as that really has nothing to do with RE and the gift.JoAnn Strommen:

Yes, our broker sells it immediately. When I said I sell it, I mean the process of changing it from a stock/property gift to a stock/property sold.

With a volatile stock market there can be and often are some gains/losses from the time our broker gets the gift from the donor and sells it for us.0 -

Our brokers sell stocks right

away. The gift date is the book in date, the stock sale

date is the actual date of sale and the GL post date is the cheque

deposit date. The gain/loss and broker fees are recorded in

RE and then posted to FE.The only time we need to adjust/review this is

when we receive a US $ cheque (we are a Canadian organization) and

then in FE we may need to adjust gain/loss due to exchange

differences,Ann

K.

Ann Pennant, CPA CMADirector of Finance & Human

ResourcesGovernance

OfficerPearson College UWC

P 250-391-2407 F 250-391-2412

650

Pearson College Drive, Victoria B.C., Canada V9C

4H7Website | Facebook | Twitter | LinkedIn | YouTube

0 -

It's been quite awhile since I had to process a stock gift so I just pulled up a record for a gift. The gift record when I look at the Sold Stock/Prop Information shows the stock sale, broker fees, other details and and at the bottom of the window a Loss amount. For us, it looks like it is all recorded on the RE side.

My memory fails on all the details, sorry.0 -

Ann Pennant:

Our brokers sell stocks right away. The gift date is the book in date, the stock sale date is the actual date of sale and the GL post date is the cheque deposit date. The gain/loss and broker fees are recorded in RE and then posted to FE.

The only time we need to adjust/review this is when we receive a US $ cheque (we are a Canadian organization) and then in FE we may need to adjust gain/loss due to exchange differences,

Ann

K. Ann Pennant, CPA CMA

Director of Finance & Human Resources

Governance Officer

Pearson College UWC

P 250-391-2407 F 250-391-2412

650 Pearson College Drive, Victoria B.C., Canada V9C 4H7

Website | Facebook | Twitter | LinkedIn | YouTube

Thank you!

0 -

JoAnn Strommen:

It's been quite awhile since I had to process a stock gift so I just pulled up a record for a gift. The gift record when I look at the Sold Stock/Prop Information shows the stock sale, broker fees, other details and and at the bottom of the window a Loss amount. For us, it looks like it is all recorded on the RE side.

My memory fails on all the details, sorry.Thank you so much for all your help.

0 -

https://kb.blackbaud.com/articles/Article/46483

When you look at this Knowledgebase article it does not seem necessary that you post to GL first and then enter the sale, but I think this would be a good question for RE support.

1 -

Michele Thompson:

Happy New Year!

We are perplexed on entering stock gifts in RE they are not coming over right to FE. So a few questions as I don't think we are doing it correcly. We have been entering the stock gift with the date we receive it, hitting save and then putting the sale in then posting. It am wondering if this is messing up the FE posting. Our accounts are not balancing. This may be a two party question, RE and FE, but maybe someone works closely enough like we do that you might have the answers.

1. When you receive a stock gift, do you enter it and post it? THEN when you sell it post that?

We are finding that the gains/losses are not posting correctly in FE. Is it the way we are posting or how we have the accounts set up for the funds? We have tried so many different ways. As you can see, when the stock gift was made and on Dec. 21 the money is debiting into the Merrill Lynch Acct and crediting Stocks. The problem here is that we received the stock on 12/21 and we sold iton 1/8 which is the date we put into RE. BUT for some reason (maybe because we entered the gift and sale on the same day THEN posted) it isn't hitting the accounts correctly. We wrote the check from ML for $20,082 and the $465 should stay in the ML account as a gain. But when you look they cancel each other out and the gain doesn't stay in the account. The credit of $465 to the checking account is correct so that our deposit is correct, but we aren't seeing the gain stay in the ML account. Is this because we should post the sale first before we sell it? SOOO confused and my Finance Manager is going nuts trying to get her accounts to balance.

Thank you so much for your help!

Michele

0

Categories

- All Categories

- Shannon parent

- shannon 2

- shannon 1

- 21 Advocacy DC Users Group

- 14 BBCRM PAG Discussions

- 89 High Education Program Advisory Group (HE PAG)

- 28 Luminate CRM DC Users Group

- 8 DC Luminate CRM Users Group

- Luminate PAG

- 5.9K Blackbaud Altru®

- 58 Blackbaud Award Management™ and Blackbaud Stewardship Management™

- 409 bbcon®

- 2.1K Blackbaud CRM™ and Blackbaud Internet Solutions™

- donorCentrics®

- 1.1K Blackbaud eTapestry®

- 2.8K Blackbaud Financial Edge NXT®

- 1.1K Blackbaud Grantmaking™

- 527 Education Management Solutions for Higher Education

- 1 JustGiving® from Blackbaud®

- 4.6K Education Management Solutions for K-12 Schools

- Blackbaud Luminate Online & Blackbaud TeamRaiser

- 16.4K Blackbaud Raiser's Edge NXT®

- 4.1K SKY Developer

- 547 ResearchPoint™

- 151 Blackbaud Tuition Management™

- 1 YourCause® from Blackbaud®

- 61 everydayhero

- 3 Campaign Ideas

- 58 General Discussion

- 115 Blackbaud ID

- 87 K-12 Blackbaud ID

- 6 Admin Console

- 949 Organizational Best Practices

- 353 The Tap (Just for Fun)

- 235 Blackbaud Community Feedback Forum

- 55 Admissions Event Management EAP

- 18 MobilePay Terminal + BBID Canada EAP

- 36 EAP for New Email Campaigns Experience in Blackbaud Luminate Online®

- 109 EAP for 360 Student Profile in Blackbaud Student Information System

- 41 EAP for Assessment Builder in Blackbaud Learning Management System™

- 9 Technical Preview for SKY API for Blackbaud CRM™ and Blackbaud Altru®

- 55 Community Advisory Group

- 46 Blackbaud Community Ideas

- 26 Blackbaud Community Challenges

- 7 Security Testing Forum

- 1.1K ARCHIVED FORUMS | Inactive and/or Completed EAPs

- 3 Blackbaud Staff Discussions

- 7.7K ARCHIVED FORUM CATEGORY [ID 304]

- 1 Blackbaud Partners Discussions

- 1 Blackbaud Giving Search™

- 35 EAP Student Assignment Details and Assignment Center

- 39 EAP Core - Roles and Tasks

- 59 Blackbaud Community All-Stars Discussions

- 20 Blackbaud Raiser's Edge NXT® Online Giving EAP

- Diocesan Blackbaud Raiser’s Edge NXT® User’s Group

- 2 Blackbaud Consultant’s Community

- 43 End of Term Grade Entry EAP

- 92 EAP for Query in Blackbaud Raiser's Edge NXT®

- 38 Standard Reports for Blackbaud Raiser's Edge NXT® EAP

- 12 Payments Assistant for Blackbaud Financial Edge NXT® EAP

- 6 Ask an All Star (Austen Brown)

- 8 Ask an All-Star Alex Wong (Blackbaud Raiser's Edge NXT®)

- 1 Ask an All-Star Alex Wong (Blackbaud Financial Edge NXT®)

- 6 Ask an All-Star (Christine Robertson)

- 21 Ask an Expert (Anthony Gallo)

- Blackbaud Francophone Group

- 22 Ask an Expert (David Springer)

- 4 Raiser's Edge NXT PowerUp Challenge #1 (Query)

- 6 Ask an All-Star Sunshine Reinken Watson and Carlene Johnson

- 4 Raiser's Edge NXT PowerUp Challenge: Events

- 14 Ask an All-Star (Elizabeth Johnson)

- 7 Ask an Expert (Stephen Churchill)

- 2025 ARCHIVED FORUM POSTS

- 322 ARCHIVED | Financial Edge® Tips and Tricks

- 164 ARCHIVED | Raiser's Edge® Blog

- 300 ARCHIVED | Raiser's Edge® Blog

- 441 ARCHIVED | Blackbaud Altru® Tips and Tricks

- 66 ARCHIVED | Blackbaud NetCommunity™ Blog

- 211 ARCHIVED | Blackbaud Target Analytics® Tips and Tricks

- 47 Blackbaud CRM Higher Ed Product Advisory Group (HE PAG)

- Luminate CRM DC Users Group

- 225 ARCHIVED | Blackbaud eTapestry® Tips and Tricks

- 1 Blackbaud eTapestry® Know How Blog

- 19 Blackbaud CRM Product Advisory Group (BBCRM PAG)

- 1 Blackbaud K-12 Education Solutions™ Blog

- 280 ARCHIVED | Mixed Community Announcements

- 3 ARCHIVED | Blackbaud Corporations™ & Blackbaud Foundations™ Hosting Status

- 1 npEngage

- 24 ARCHIVED | K-12 Announcements

- 15 ARCHIVED | FIMS Host*Net Hosting Status

- 23 ARCHIVED | Blackbaud Outcomes & Online Applications (IGAM) Hosting Status

- 22 ARCHIVED | Blackbaud DonorCentral Hosting Status

- 14 ARCHIVED | Blackbaud Grantmaking™ UK Hosting Status

- 117 ARCHIVED | Blackbaud CRM™ and Blackbaud Internet Solutions™ Announcements

- 50 Blackbaud NetCommunity™ Blog

- 169 ARCHIVED | Blackbaud Grantmaking™ Tips and Tricks

- Advocacy DC Users Group

- 718 Community News

- Blackbaud Altru® Hosting Status

- 104 ARCHIVED | Member Spotlight

- 145 ARCHIVED | Hosting Blog

- 149 JustGiving® from Blackbaud® Blog

- 97 ARCHIVED | bbcon® Blogs

- 19 ARCHIVED | Blackbaud Luminate CRM™ Announcements

- 161 Luminate Advocacy News

- 187 Organizational Best Practices Blog

- 67 everydayhero Blog

- 52 Blackbaud SKY® Reporting Announcements

- 17 ARCHIVED | Blackbaud SKY® Reporting for K-12 Announcements

- 3 Luminate Online Product Advisory Group (LO PAG)

- 81 ARCHIVED | JustGiving® from Blackbaud® Tips and Tricks

- 1 ARCHIVED | K-12 Conference Blog

- Blackbaud Church Management™ Announcements

- ARCHIVED | Blackbaud Award Management™ and Blackbaud Stewardship Management™ Announcements

- 1 Blackbaud Peer-to-Peer Fundraising™, Powered by JustGiving® Blogs

- 39 Tips, Tricks, and Timesavers!

- 56 Blackbaud Church Management™ Resources

- 154 Blackbaud Church Management™ Announcements

- 1 ARCHIVED | Blackbaud Church Management™ Tips and Tricks

- 11 ARCHIVED | Blackbaud Higher Education Solutions™ Announcements

- 7 ARCHIVED | Blackbaud Guided Fundraising™ Blog

- 2 Blackbaud Fundraiser Performance Management™ Blog

- 9 Foundations Events and Content

- 14 ARCHIVED | Blog Posts

- 2 ARCHIVED | Blackbaud FIMS™ Announcement and Tips

- 59 Blackbaud Partner Announcements

- 10 ARCHIVED | Blackbaud Impact Edge™ EAP Blogs

- 1 Community Help Blogs

- Diocesan Blackbaud Raiser’s Edge NXT® Users' Group

- Blackbaud Consultant’s Community

- Blackbaud Francophone Group

- 1 BLOG ARCHIVE CATEGORY

- Blackbaud Community™ Discussions

- 8.3K Blackbaud Luminate Online® & Blackbaud TeamRaiser® Discussions

- 5.7K Jobs Board